2020 Peak Season e–commerce forecast

There’s no doubt that 2020 has been a challenging year for everyone. But how has it affected the e–commerce market in Q3, and what are the expectations for Q4? As the industry gears up for peak season, you might be wondering as an e–commerce business owner what you should focus on. We’ll be sharing just that in this article, so get up to speed with the market with our 2020 peak season e–commerce forecast.

Overview of Q3 e–commerce market

Unsurprisingly, the impact of Covid-19 across the world has seen an increase in e–commerce sales as high streets were locked down and consumers were unable to shop in-person.

In Europe’s three biggest e–commerce markets (the UK, France and Germany), the share of customers doing at least 50% of their shopping online has increased dramatically – between 25% and 80% in each of these countries (Internet Retailing).

In all of these markets, six out of ten consumers stated that they’d continue to shop online as much after the pandemic has passed, according to a survey commissioned by Kantar, looking at the biggest retail markets in Europe. Around 80% of participants said that they’ll continue to shop online for non-essentials in 2020.

This trend can be seen all around the world. Criteo collated data from 14,000 retailers globally. They found 88% of customers surveyed planned to buy gifts online over the holiday period.

According to another Criteo survey, nearly 9 customers out of 10 (85%) worldwide intend to continue to buy at e–commerce they discovered during lockdown.

E–commerce Holidays Sales would reach $182 billions

One major consideration for retailers as we move swiftly into Q4 is what impact Covid-19 will have on holiday shopping. This year, looking at trends from last year won’t be enough to plan your holiday strategy. It’ll require analysis of the current and expected state of play. It’s crucial to look at forecasts to determine where you should invest budget.

A Deloitte report found that e–commerce sales are expected to grow by between 25% and 35% year-on-year during the upcoming holiday season. In 2019, sales increased by just 14.7% over the holiday period, in comparison.

The categories with the biggest opportunities are clothing and home electronics. In these product categories, 50-60% of consumers plan to purchase online in 2020.

The growth of e–commerce is perhaps even better exemplified by looking at other sales channels. Before the pandemic, shopping online was supplementary for most people. Bricks and mortar stores were their primary method of shopping. Covid-19 and the lockdown changed that. The landscape was transformed as e–commerce became the primary sales channel for most people.

In the UK it took a full 10 years for e–commerce to grow from 10% to 20% as a proportion of all retail sales in the country. During the pandemic, however, that figure increased from 20% to 30% in just 8 weeks.

This is evident when looking at retailers who didn’t have an online presence, such as Primark. That particular retailer reported lost revenue of £650m per month. Sales in the quarter to June 2020 were down by 75% (Econsultancy).

Consumer attitudes

Although physical retailers have now been able to reopen their doors, many consumers have no intention of changing their shopping habits. There’s still an appetite for in-store shopping, but it looks like a more blended approach may be the way forward. This means that retailers should invest in their online presence. They should ensure that they offer a great service and a wide range of products for consumers who can’t, or don’t want to, hit the high street.

60% of consumers said that they plan to shop less in-store this season due to fear of Covid-19 exposure (Prnewswire). A survey by AfterPay highlighted that there are a couple of factors that are driving consumers to shop online more. It found that 48% are doing so to avoid people in shops, and 46% are shopping online for convenience (Econsultancy). This shows that the pandemic is likely to have an impact on consumer behavior in the long-term, reaching far beyond the end of any lockdowns.

The pandemic has also had the unexpected impact of introducing consumers to online retailers that they may not previously have discovered. If ever there was a time to step up your online marketing efforts to increase your brand visibility and help potential new customers to discover your e–commerce store, now is it.

In a study conducted by Criteo, it was found that during lockdown customers’ habits have changed: they started to buy in online supermarkets and from small merchants that previously didn’t know about:

A well as an increase in online shopping, there’s also been an increase in the number of people placing orders online to be picked up in-store. This minimises the amount of time consumers need to spend outside their own homes. The number of Buy Online Pick Up In-Store orders increased from 1% of all orders in March to 4% of all orders in June. BOPIS orders have stayed steady throughout Q3. They remained at 3% in July before dipping to 2% in August. They then saw an increase in September again, to 3% (Signifyd).

It seems that, despite the impact Covid-19 has had on delivery times, shoppers aren’t intending to plan ahead when it comes to their holiday shopping this year. 41% of shoppers say that they have no plans to do their holiday shopping any earlier than usual. 39% of shoppers plan to start their holiday shopping in October or early November, whilst 30% are looking to start on Black Friday or Cyber Monday (Prnewswire).

2020 Peak Season important dates

What, exactly, are the key dates you need to keep in mind as you’re planning your product and marketing strategy for Q4?

Prime Day

Usually, Prime Day is held in July. Prime Day is Amazon’s very own version of Black Friday, where the e–commerce giant offers exclusive deals to Prime customers. This year, due to the pandemic, Prime Day has been pushed back and will now be held on October 13th-14th. Typically Black Friday marks the countdown to Christmas. This year, Prime Day represented the start of the holiday shopping season.

Prime Day is a big deal. In 2019, the most-purchased items on Prime Day were computers and electronics, which accounted for 41% of items purchased (Digital Commerce 360). Fashion and accessories are another great category to focus on for Prime Day, making up 29% of sales last year. Finally, hardware and home goods are key, with 23% of last year’s sales.

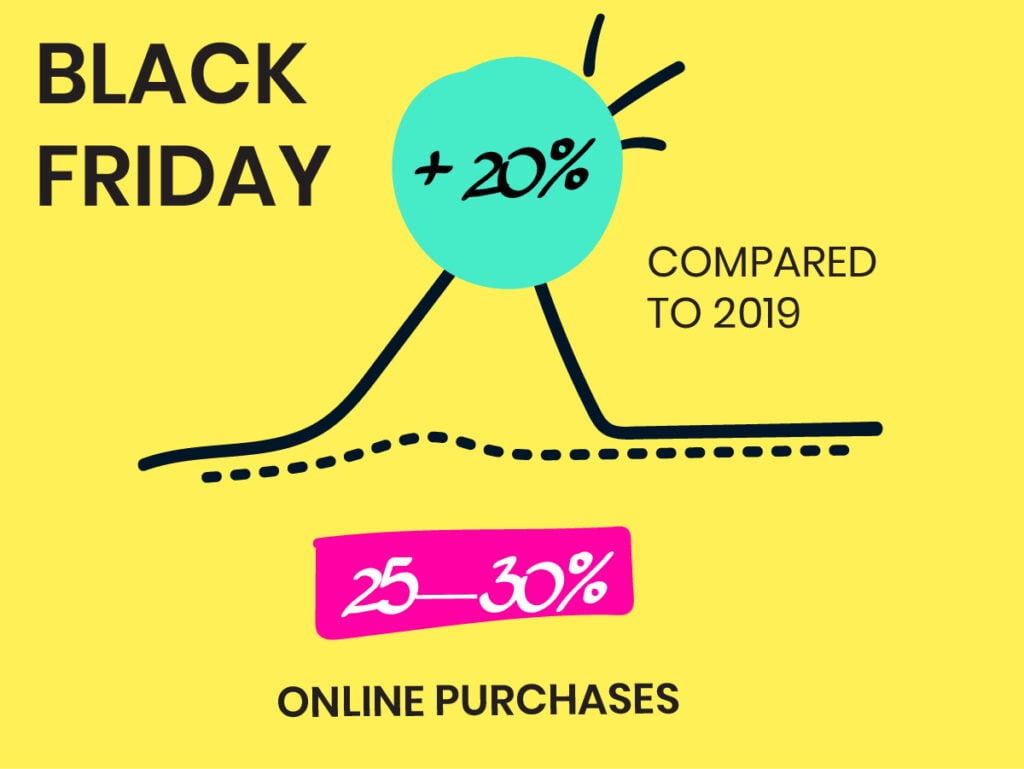

Black Friday and Cyber Monday

Authority site theblackfriday.com predicts a different Black Friday this year. They expect that Black Friday sales will launch earlier in 2020, with retailers hoping to make the most of customers’ desire for online shopping. In the States, many of the biggest Black Friday retailers, including Walmart, Target and Best Buy, have announced that their stores won’t open on Thanksgiving, and it’s expected that they’ll remain closed on Black Friday too.

This means that all Black Friday sales – this year it falls on the 27th of November – will be focused online, perhaps starting even earlier than usual. For example, Home Depot has already confirmed that it’ll be starting early by offering its Black Friday pricing during November and December.

Cyber Monday is the second highly awaited event for pre-Christmas online shopping. It falls on the Monday following Black Friday – this year it will be on November 30th – and marks the closure of the offers of the period.

Last year Cyber Monday hit a new record of over $9 billion in sales, marking the first day in history when consumers have spent over $3 billion using their smartphones (Adobe Analytics).

Growing product sectors

What have consumers been buying online during Q3, and what can we expect to be popular going into the holiday season?

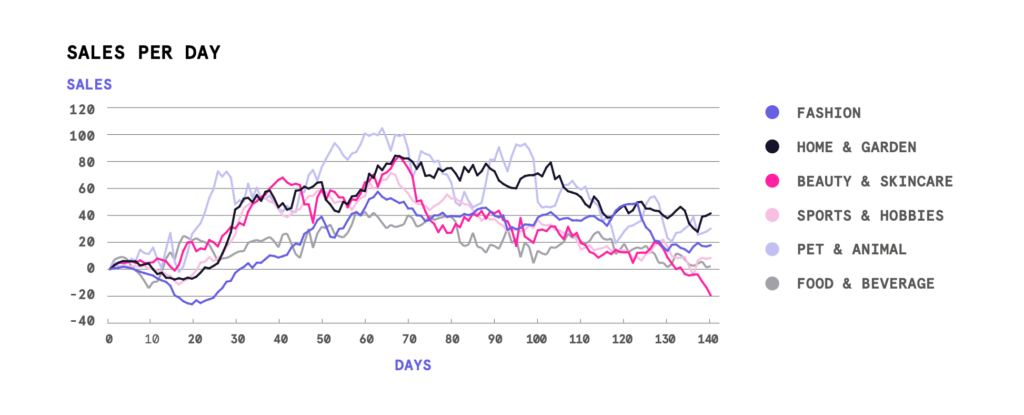

By the end of Q3, e–commerce traffic had increased year-on-year for all verticals with the exception of Beauty and Skincare. At the end of this period, Animal & Pet Supplies, Home & Garden and Fashion & Accessories all had significantly more traffic than at the start of the period, with each vertical increasing by 15% or more. Beauty & Skincare, however, was down by 11% (Nosto).

Analysis from March 1st, 2020 to August 1st.

Fashion and Accessories was a popular category for shoppers during lockdown. By the end of Q3, visits were up 15%, sales up 18% and conversion rates up 12% compared to the start of the timeframe. This vertical has seen the type of growth that might usually be expected over a year in a greatly reduced timeframe.

Home and Garden is another vertical that’s benefitted from the explosion in online shopping, with many people turning to home improvements and gardening over lockdown. This product category has seen visits increase by 24%, sales by 24%, conversion rates improve by 5% and an average order value increase of 6%.

Peak Season forecast by country

Although trends are broadly the same across countries, there are some specific nuances to note. We’ve broken down the state of play and Q4 forecast by country so you can more carefully tailor your strategy to the particular situation in your locale.

France

Back in July, we wrote that the Xerfi study “Ecommerce in France by 2020” had forecast that there would be a 60% increase in online sales between 2014 and 2020. These figures were, however, calculated pre-pandemic, and things have changed for the French e–commerce market now.

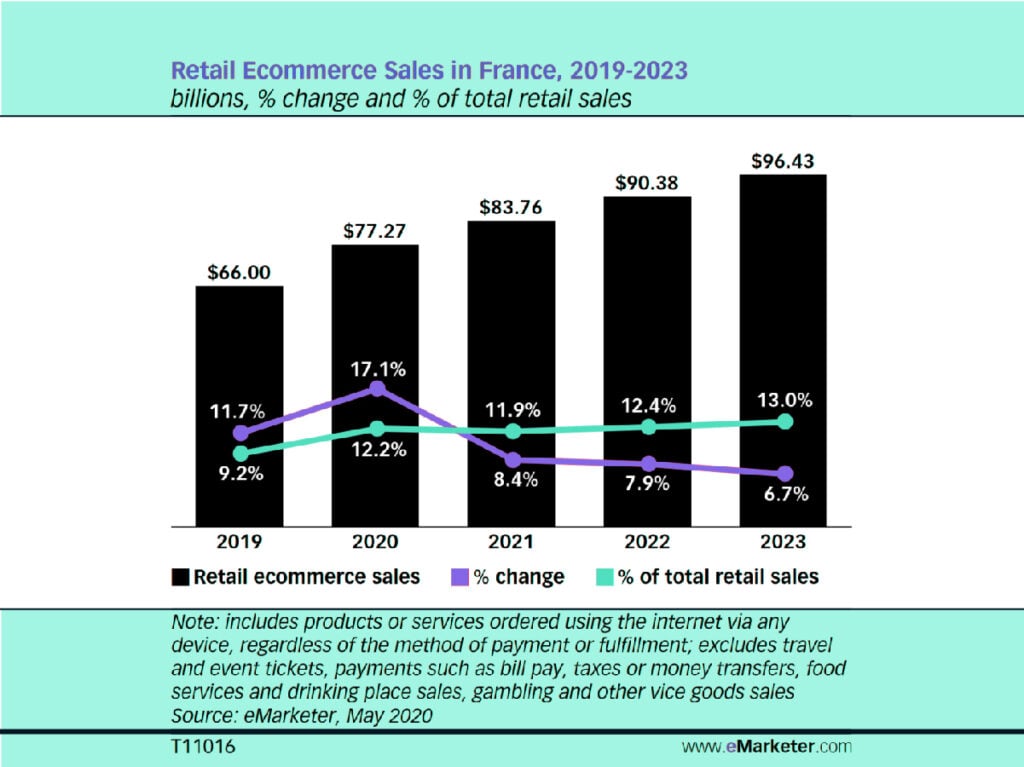

In France, more people than ever before have been shopping online. The lockdown in France was strict, meaning that consumers were shopping online more across all sectors, including groceries. It’s expected that retail e–commerce sales in France will total $77.27 billion (€69.01 billion) in 202, compared to $66.00 billion (€58.94 billion) in 2019 (eMarketer).

The most popular product categories across the country in 2020 include home furnishings, which saw a 97.8% increase in transactions as of April 26th (Statista). Technology was another popular category, where transactions increased by 87.6%. Fashion has seen a 23% increase in transactions, and cosmetics saw transactions increase by 26.5%.

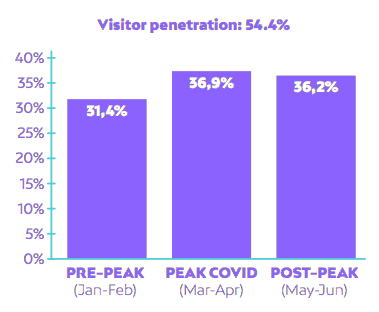

During lockdown in France, nearly 30% of the country’s residents bought a fashion item online. This includes 2.6 million new customers who hadn’t previously shopped online. This means that e–commerce fashion sales accounted for 23.8% of the total sales in this vertical during the first half of 2020.

It seems likely that fashion e–commerce will continue to succeed. This means that e–commerce retailers selling fashion and accessories are in a prime position to capitalise on this new trend moving into Q4. Shops reopened in France on May 11th, but 17% of consumers in France exclusively bought online between May and June 2020, with 46% of shoppers stating that they would purchase online again within the next 12 months.

Spain

It’s a similar story in Spain. Netquest found that between January and June 2020, 54% of Spanish internet users visited FMCG sites during lockdown. Roughly 28% of these shoppers made a purchase. Overall, it’s expected that Spain’s e–commerce industry will grow by around 22.9% in 2020 (Emarsys). That puts it on track to be the fastest-growing online industry in Europe for the second year in a row. This is broadly in line with what we reported on in 2019, where we forecast that the number of e–commerce sales in Spain was set to increase in 2019 and 2020, from 27.2% in the second quarter of 2018.

Spanish grocery retailers experienced an unprecedented increase in online transactions during the lockdown period. They saw an increase of over 200% for household products, food and beverages. Other verticals have also seen a marked increase in online sales, including fashion.

Italy

As with Spain, Italy saw a surge in online shopping during lockdown. In 2020, online sales in Italy are predicted to reach €22.7 billion, which equates to a year-on-year increase of 26% (Netcomm). Similar to other other countries, online grocery orders skyrocketed during lockdown, with orders amounting to €4.5 billion. Furniture and home living has been another popular vertical, with sales of €2.3 billion. Other verticals have also increased in sales over lockdown. This includes IT and consumer electronics (worth €6 billion), clothing (€3.9 million) and publishing (€1.2 billion).

It can be expected that online shopping will continue to be popular in Italy during the 2020 holiday season and beyond. According to Casaleggio Associati, 76% of e–commerce users in Italy made an online purchase within the past year, which is even higher than the European average of 64%.

United States

The United States is one of the largest consumers of e–commerce in the world. According to data from the IBM’s US Retail Index, the pandemic has hit the fast-forward button on online shopping. It’s accelerated the transition from shopping in physical stores to online shopping by roughly five years.

Online shopping shows no signs of slowing down. Although e–commerce sales were slightly reduced in Q3 compared to Q2, many consumers in the US were still making the most of digital shopping, with figures far higher than the previous year. In July, e–commerce sales were up 55% to $66.3 billion, compared with the same month in 2019.

Americans are also turning to curbside pickup as a way of avoiding physical stores. If your online store has the ability to offer this service, it’s worth adding it as a delivery option. Alternatively, you could give customers the option to collect their order from a local pickup point. At the end of 2019, 6.9% of the 245 retailers listed in the Digital Commerce 360 Top 500 offered curbside pickup. By August 2020, this figure had increased dramatically to 43.7%.

Catch the Peak Season wave with ShippyPro

E–commerce orders are expected to grow by 35% during peak season 2020 (Deloitte). Do you have the right automation platform to take advantage of such an increase?

ShippyPro is the perfect solution for online merchants who are looking to save time and money whilst improving their customer experience.

ShippyPro is a complete shipping hub for e–commerce, integrated with 63 Sales Channels and more than 120 Carriers so you can manage everything in one place. It offers the perfect features to capture peak season opportunities including:

- Label Creator, which allows you to automate the printing of shipping labels with just one easy click

- Track & Trace, which offers everything you need to send branded shipping notifications to your customers, keeping them up to date with the status of their order

- Easy Return, an all-in-one portal which reduces the headache of dealing with customer returns

- Ship & Collect, offering your customers multiple delivery options at checkout, including real-time shipping rates and pickup locations, so they can choose the option that best suits their needs

Sources:

Criteo

Criteo

Econsultancy

Prnewswire

Signifyd

Digital Commerce 360

theblackfriday.com

Nosto

eMarketer

Netquest

Statista

Emarsys

Netcomm

Casaleggio Associati

IBM’s US Retail Index

ShippyPro is the complete shipping software for online and offline retail. With Label Creator, Track & Trace, Easy Return and Analytics features, our software simplifies your shipping operations. ShippyPro integrates with over 180 carriers and 80 sales channels, making it compatible with a wide range of products and use cases.

.jpg)