5 top tips for a smooth customs clearance process

As an e–commerce company, you can have international shipments for several different reasons. Maybe you’re importing material to be utilized in a domestic factory. Or maybe you’re importing products from your manufacturer. Or perhaps, you’re shipping product to an warehouse in another country or a warehouse that you use for sales made via your Shopify site.

Undoubtedly, as your e–commerce company grows, you will have to deal with customs.

In this post, we walk you through a deeper understanding of the Customs Clearance process and offer tips to help you pass customs as smoothly as possible.

What is Customs Clearance?

Customs Clearance refers to passing goods through customs so that they can enter or leave a country. Each country has its own customs department that you need to comply with.

Typically customs requires you to fulfill the documentation requirements as well as pay the correct duties so that goods can be received.

How does the Customs Clearance process work?

Every country has their own customs requirements, but the process is similar around the world.

Here’s how the customs process works:

- The customs officer reviews all of the paperwork you have included with your shipment. This always includes the commercial invoice, which is required for any international shipment, and it may include other documents too, such as health certifications.

- The customs officer will then see what, if any, taxes and duties should be applied. Type of product, amount of product, and country laws will all affect the taxation and duties.

- The customs officer will ask for payment of the taxes and duties. If they have not yet been paid for in advance by the shipper, then this is when the receiver would need to pay for them. You can negotiate with your suppliers about using Incoterms (discussed further below).

- The customs officer then releases the shipment once everything is paid and the correct documents have been collected.

5 tips for a smooth Customs Clearance process

To make the Customs Clearance process as smooth as possible, we recommend that you follow these 5 important tips. We will take as an example a typical Custom Clearance process with our partner FedEx.

Tip 1. Make sure your commercial invoice is complete, and the goods description is accurate

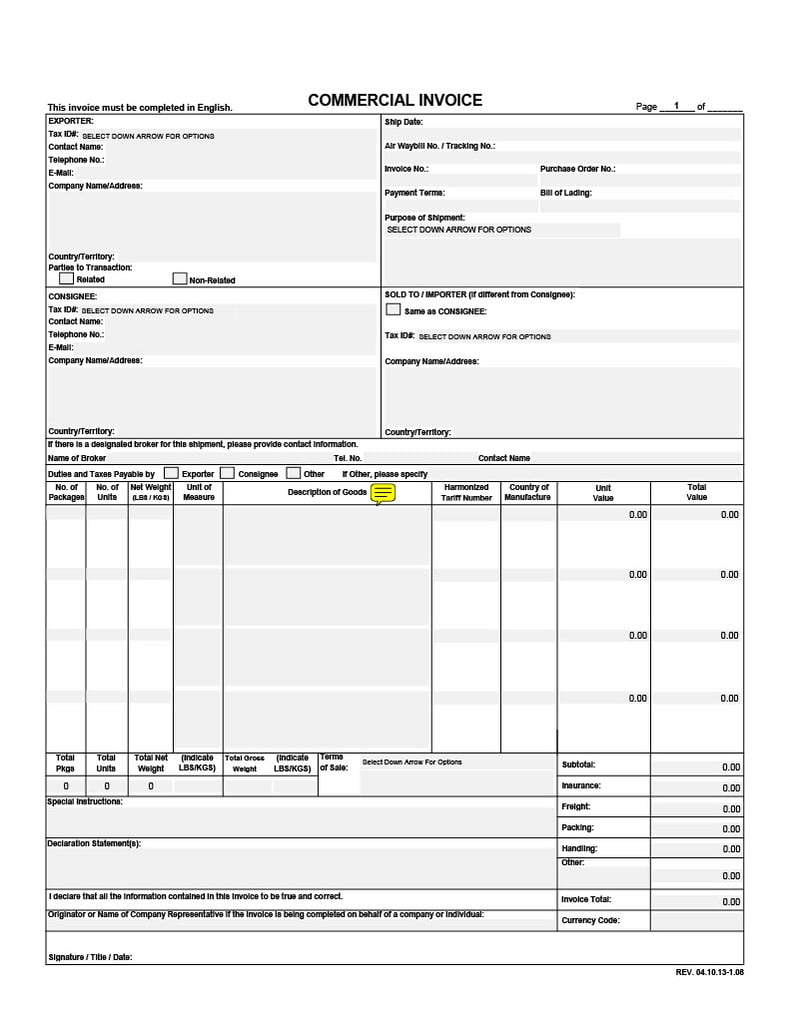

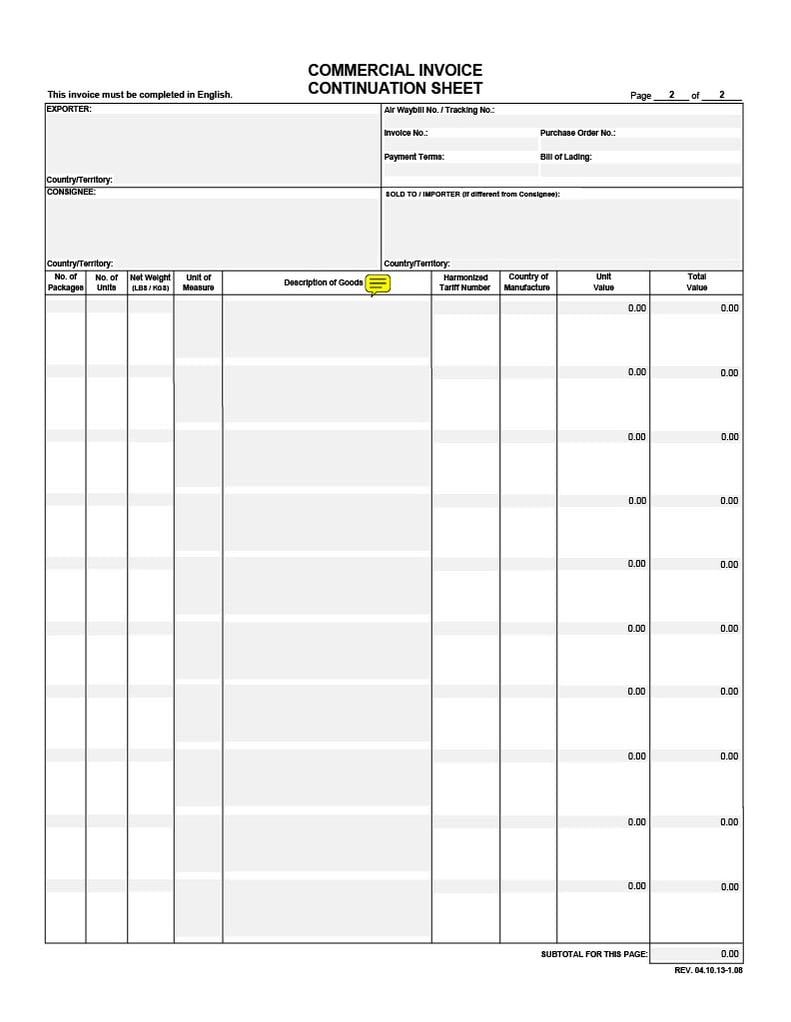

You’ll need to create a commercial invoice for the import. You can make this with FedEx inside of your FedEx account. Here’s their template for a commercial invoice:

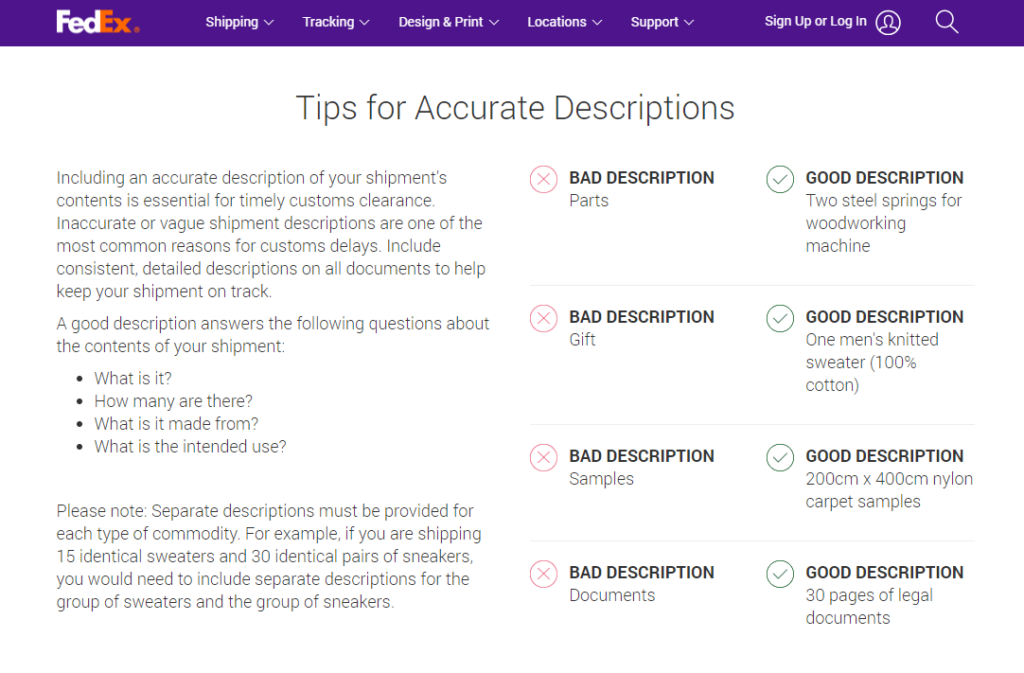

When creating your commercial invoice, make sure to use accurate descriptions. Don’t just provide the bare minimum description, but be sure to include plenty of details.

On their website, FedEx includes some examples of bad and good descriptions.

We recommend that you provide us the paperwork digitally, this way the paperwork is always accessible.

You’ll also need to include a complete and accurate waybill. A waybill is a required document that is issued by the Carrier. It acknowledges their receipt and possession of the shipment. It should include the destination address and receiver’s contact information. Think of it like a receipt. You will get it from the Carrier, and you should keep a copy for yourself and add the original to your shipment.

Tip 2. Choose your international commercial terms (Incoterms) wisely

There are different types of import deliveries essentially outline whose responsibility it is to get goods through customs:

- Incoterms define the point in the shipping process when the responsibilities for a shipment (such as risk, costs and insurance) shift from sender to receiver. Before goods are shipped, the sender and receiver agree on the Incoterms, which specify who pays for what shipping costs.

- DAP stands for “delivery at place” while DDP stands for “delivered duty paid.”

But what do these terms actually mean, and how do they affect the customs clearance process?

- DAP – Seller is responsible for delivery of the goods to the buyer’s destination but is not responsible for import formalities and costs.

- DDP – Seller must deliver goods at their own expense and risk, handle all formalities, and pay for the import duties as well as any other costs.

Sellers often prefer to do DAP of course, but you should choose DAP or DDP with your suppliers based on which company has the most expertise with passing customs into that country. For each supplier, you can speak with them to learn who is the most experienced and make your decision that way.

Tip 3. Research other required documents for certain product types and individual countries

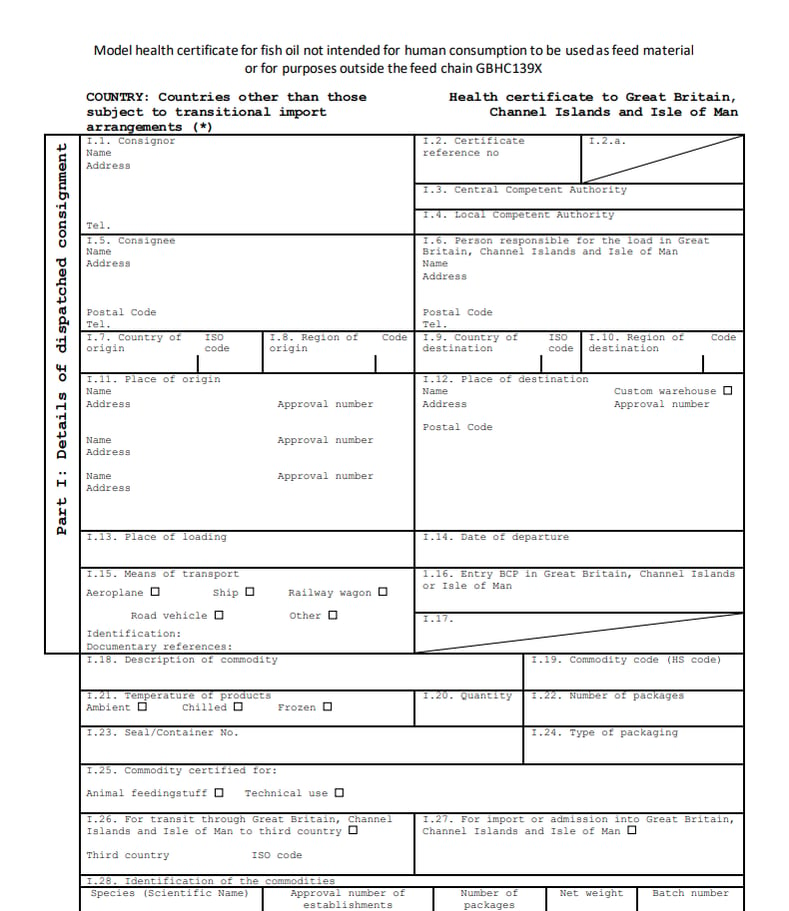

Depending on what product is being shipped to what country, there can be other documents required besides the invoice and waybill.

For example, when shipping perishable goods, you’ll likely need to include a health certificate. Animal products also usually require the inclusion of a health certificate. Here you can find the animal product health certificates required by Great Britain.

Not sure how to find what other documents might be required?

Visit the government website of the country you’re exporting from and importing to.

Tip 4. Don’t put your documents inside of the shipment

The commercial invoice and waybill are supposed to be attached securely to the shipment, not placed inside. If using FedEx, you can create the invoice document with the FedEx Ship Manager in your FedEx account.

Placing the documents inside of the shipment can cause majorly delays and get your products stuck in customs for quite some time, as customs workers are not going to immediately open the shipment and search for the paperwork, out of safety concerns.

Tip 5. Keep detailed records and copies

Create a digital folder in a secure cloud storage solution such as Box or Dropbox that is specifically for your customs documents. Scan and upload any paper documents so that you can more easily keep track of things. Make sure that you’re also organizing your digital file folders. Create one folder per year, then within that you can create folders for the date of each shipment.

How FedEx facilitates your custom procedures

Do you ship internationally? If so, partnering with FedEx as your Carrier will be a smart move. The company offers customs clearance assistance with thousands of experts.

Here are some of FedEx’s helpful resources you might want to explore:

- FedEx International Shipping Assist – Easily fill out information about your international shipment to receive the required customs documentation.

- FedEx Electronic Trade Documents – Upload your required customs documents electronically for faster processing.

- FedEx Global Trade Manager – Get international documents, estimate duties and taxes, and troubleshoot any issues.

- FedEx Shipping Channel: A hub where you can find everything you need to expand your customs clearance knowledge.

Are you shipping to the UK?

After Brexit, the UK is officially no longer part of the EU. In our comprehensive guide to post-Brexit, we included plenty of insights for e–commerce companies as to how to handle this transition.

One thing that Brexit affects is customs. When shipping to the UK, you will need to make sure that you’re completing a commercial invoice and any required certifications, based on the product type.

Read more: Shipping to Europe from the UK: an updated guide

Why use ShippyPro for your international shipments

With our FedEx integration, you can easily manage shipments and returns for your e–commerce store. ShippyPro offers easy-print labels for both shipments and returns. When you use ShippyPro with FedEx, you can take the hassle out of international shipments with auto-generated labels and customs documentation.

ShippyPro is the complete shipping software for online and offline retail. With Label Creator, Track & Trace, Easy Return and Analytics features, our software simplifies your shipping operations. ShippyPro integrates with over 160 couriers and 80 sales channels, making it compatible with a wide range of products and use cases.