CN22 vs CN23: What’s the Difference? The 2026 Guide

By

Ashley Brown

·

4 minute read

By

Ashley Brown

·

4 minute read

Is Your Package Wearing the Wrong "Sticker"? If you ship internationally via the postal network, your package needs a passport. In the world of logistics, that passport is a customs declaration form. But walking up to the counter—or printing labels from your warehouse—often leads to a moment of panic: "Do I need the small green sticker (CN22) or the full white document (CN23)?"

Making the wrong choice is more than just a paperwork error. It can result in your shipment being held at the border, rejected by the destination country, or your customer being hit with unexpected administrative fees. Whether you are shipping pre-loved clothes to France or electronics to the USA, understanding the "300 SDR" rule is essential. This guide breaks down exactly which form to use, when to use it, and how to fill it out perfectly to ensure your goods fly through customs.

KEY TAKEAWAYS

The Basics & The "SDR" Confusion

CN22 and CN23 are standardized customs declaration forms created by the Universal Postal Union (UPU). They tell customs officers exactly what is inside a package so they can assess Duties and VAT.

- CN22: A small sticker (usually 74mm x 105mm) attached to the side of the package.

- CN23: A detailed, full-page document (A4 or A5) attached in a clear plastic wallet on the outside.

What is an SDR? (Currency Conversion Table)

The confusion stems from the currency limits. The threshold is set in SDR (Special Drawing Rights), a basket of currencies used by the IMF.

Use this 2026 estimate table to check your local currency limit:

| Currency | 300 SDR Limit (Approx) | Action | |

|---|---|---|---|

| GBP (£) | £270.00 | If value is higher → Use CN23 | |

| EUR (€) | €355.00 | If value is higher → Use CN23 | |

| USD ($) | $395.00 | If value is higher → Use CN23 | |

| CAD ($) | $530.00 | If value is higher → Use CN23 | |

| AUD ($) | $600.00 | If value is higher → Use CN23 |

THE 3-SECOND DECISION TREE

%20(1).png?width=1080&height=1350&name=(Italian)%20(1).png)

The Comparison Matrix

| Feature | CN22 (The Sticker) | CN23 (The Full Page) | |

|---|---|---|---|

| Value Limit | Up to 300 SDR (~£270) | Over 300 SDR (~£270) | |

| Weight Limit | Max 2kg | Over 2kg (up to 20-30kg) | |

| Placement | Stuck directly on the box | Inside a clear plastic wallet (CP72) | |

| Detail Level | Basic (Description, Weight, Value) | Advanced (Plus Licenses, Comments, Insured Value) | |

| Accompanying Docs | None | Requires CP71 Dispatch Note |

If you are required to use a CN23, you usually need to attach a CP71 card as well.

The CN23 is for Customs (Duties/Taxes). The CP71 is for the Transport Provider (Address/Delivery info). They usually print together as a set.

How to Fill Them Out (The "Anti-Return" Guide)

.png?width=1410&height=2000&name=EORI%20Blog%20Checklist%20Asset%201%20(1).png)

Whether you use CN22 or CN23, the data fields are strict. "Lazy" data leads to returns. Here is the anatomy of a perfect form:

- The "Nature of Goods" Tick Box

- Commercial Sample: Only for B2B samples (often requires pro-forma invoice).

- Sale of Goods: Tick this for all B2C e-commerce orders.

- ⚠️ Warning: Never tick "Gift" for commercial sales. It is considered customs fraud.

- Description of Contents

- ❌ Bad: "Clothes", "Apparel", or "Stuff".

- ✅ Good: "Men's Cotton T-Shirt", "Running Shoes (Synthetic)", or "Wall Clock (Battery removed)".

- HS Code (Commodity Code)

- Mandatory for all commercial items. You must list at least the 6-digit code. (e.g., 6109.10 for cotton t-shirts).

- Value & Currency

- Must match the invoice inside the box. Do not undervalue items.

- Country of Origin

- Where the product was made, not where it is shipped from (e.g., "IT" for Italy, "CN" for China).

- Date & Signature

Post-Brexit Rules (UK <-> EU)

Since 2021, moving goods between the UK and EU requires these forms for Postal Services.

- Royal Mail to France: Requires CN22 or CN23 depending on value.

- La Poste to London: Requires CN22 or CN23 depending on value.

Note: If you use a courier like DHL Express or FedEx, they generate their own "Commercial Invoice" (Paperless Trade), which replaces the physical CN22/23, but the data required is exactly the same.

Frequently Asked Questions (FAQ) on CN22 vs CN23

1. What is the main difference between a CN22 and a CN23?

The main difference is the value of the shipment.

- Use CN22: If your package is worth less than 300 SDR (approx. £270 or €355). It is usually a sticker.

- Use CN23: If your package is worth more than 300 SDR. It is a full-page document that requires more detailed information and usually goes in a clear wallet.

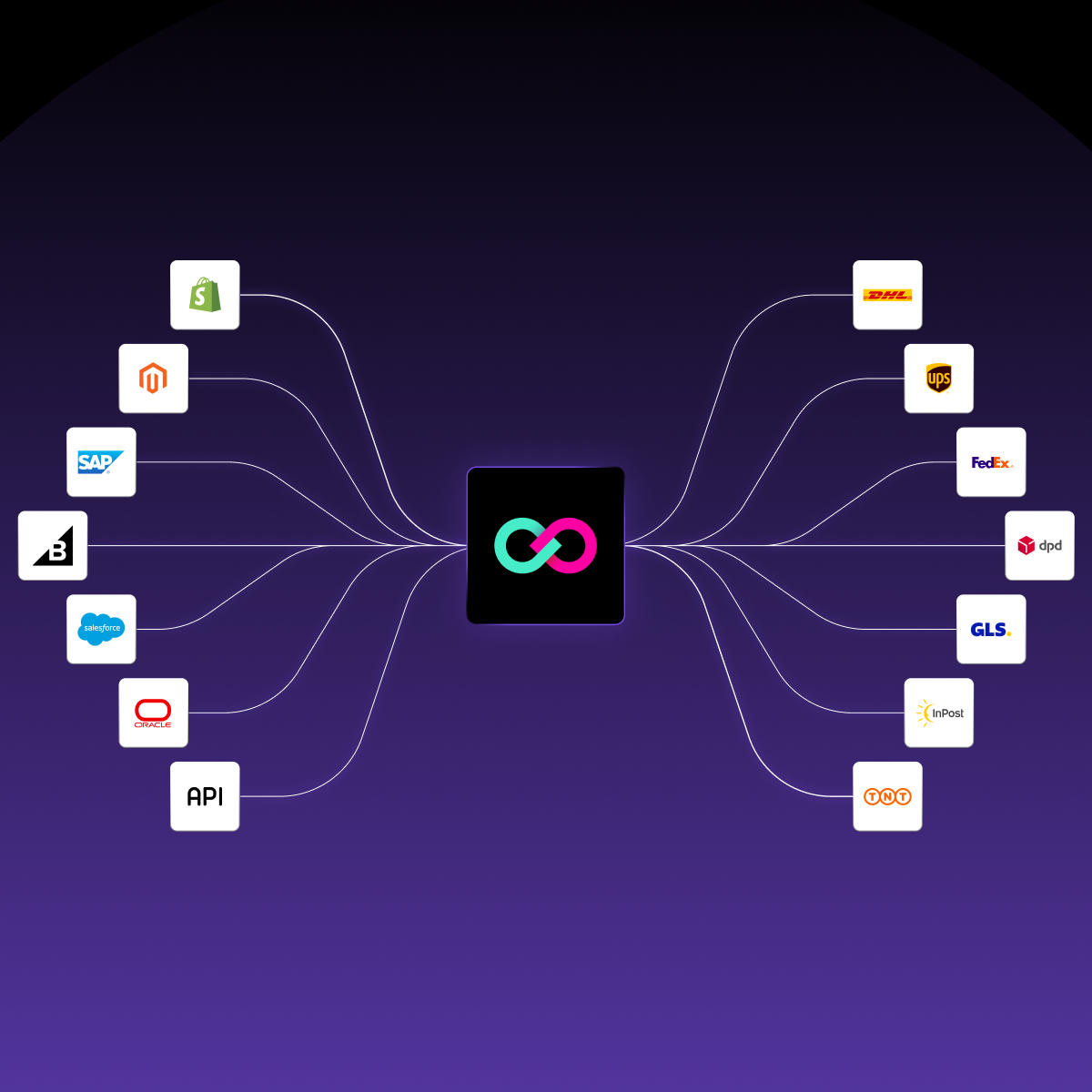

2. Do I need these forms if I ship with DHL, FedEx, or UPS?

No. The CN22/CN23 forms are specific to Universal Postal Union (UPU) members (like Royal Mail, USPS, La Poste, Poste Italiane). Private couriers like DHL or FedEx require a Commercial Invoice instead. While the data needed (HS code, value, description) is the same, the actual physical document is different.

3. I am sending a low-value item. Can I just tick "Gift"?

Absolutely not, if it is a commercial sale. Ticking "Gift" on an e-commerce order is considered customs fraud. You must tick "Sale of Goods" or "Merchandise" even if the value is low ($1). The "Gift" category is strictly for private individuals sending personal items (like a grandmother sending a birthday present).

4. Where do I stick the form on the package?

- CN22: This is usually an adhesive sticker. Place it clearly on the front of the package, ensuring it doesn't cover the address or the barcode.

- CN23: This is a larger document. It should be placed inside a clear plastic adhesive wallet (often called a "Documents Enclosed" pouch) attached to the outside of the box, so customs officers can remove and read it without opening the parcel.

5. What happens if the exchange rate changes?

The 300 SDR limit is fixed, but currency values fluctuate daily. If your shipment value is very close to the limit (e.g., £268 or €350), it is safer to upgrade to the CN23. It is better to provide too much detail than too little.

As the Growth Manager at ShippyPro, I help online retailers transform their shipping operations from a bottleneck into a growth engine. My expertise lies in ecommerce logistics and automation, specifically helping brands save time and scale efficiently. I write about the tools, strategies, and technologies that are defining the future of fulfillment.