UK customs declarations for international shipments

Learn about UK customs declarations for international shipments. Navigate regulations, ensure compliance, and streamline your import-export process.

Since Brexit, shipping parcels to the UK has become more time-consuming, expensive, and confusing, with plenty more regulations businesses have to take into account for smooth shipping and returns.

In this article we will guide you through all the information you need for a stress-free import-export process, whether you are an individual or businesses involved in international shipments to the UK.

Importance of customs declarations in international trade

Customs declarations facilitate international trade by assessing the value of the goods and by ensuring that these comply with local laws and regulations. In this way, customs authorities can assess more easily whether the goods that are being imported or exported are admissible in the country and calculate all applicable taxes.

Overview of UK customs regulations and requirements

Customs forms are required for all goods sent to the UK, except for goods sent to Northern Ireland, unless their origin is outside the EU.

If you are sending shipments within the UK or international shipments consisting of letters or documentation without monetary value, a customs declaration won’t be necessary.

Depending on the value of goods, there are different forms required:

- For goods with a value under £270, you will need a CN22 customs declaration form.

- For goods with a value over £270, you will need a CN23 customs declaration form.

Let’s discover more about them.

Types of customs declarations in the UK

When you are shipping to a customs area that is different from yours or outside the EU, you will either need a CN22 form or a CN23 form. These can be affixed directly as labels onto the package or placed inside a transparent envelope attached to it. This will ensure that all the necessary documentation is easily accessible and visible to customs authorities during the whole shipping process.

CN22

Source: Isle of Man Post Office

The CN22 form is an internationally recognized document used to declare the value of a shipment regardless of its content, facilitating B2B, B2C and C2C transactions. You need to fill this form when you are sending goods with a value under £270.

CN23

Source: Price Comparison

The CN23 form is very similar to the CN22 one but requires a few more details. You need to complete this form when you are sending goods with a value over £270.

Key elements and information required in a customs declaration

CN22 and CN23 forms must include the following information:

- The sender's contact information

- The recipient or customer’s information

- A detailed description of the contents of the package

- The nature of the shipment (commercial operation, documents, etc.)

If you are a seller, you must provide:

- The HS code of the product/s 8-digit HS Code also known as Commodity Code / Tariff Code (Click here to discover the HM Revenue & Customs classification tool).

- Your company identification number (VAT number or EORI number). The EORI Number (Economic Operators Registration and Identification Number) is a unique ID number that businesses need when moving goods between EU and non-EU countries.

Obtaining the necessary documentation and information

Engaging with customs agents or freight forwarders

Depending on the nature of your business and expertise, you can choose to complete customs declarations yourself or hire someone to take care of them, like a customs agent or freight forwarder for example, who will deal with declarations and transportation of the goods. Generally speaking, you have two options:

Customs agents

They facilitate the customs clearance process, assisting in the preparation and filling of all necessary documents. Their role is to help importers and exporters obtain the required documentation for payment of duties and taxes, thus ensuring compliance with customs regulations.

Freight forwarders

They specialize in the logistical aspects of cross-border shipping. They coordinate the transportation of goods, arrange all the necessary customs documentation, and make sure everything complies with regulations at every step of the shipping process.

Ensuring compliance with UK customs regulations

Using the correct forms and providing accurate documents and information is crucial for importers and exporters to avoid fines, additional charges for customers, delays in shipments and severe reputational damage. Failing to comply with these requirements can negatively impact the company’s bottom line and affect future business opportunities.

Step-by-Step Process of UK Customs Declarations

Here you will find a general overview of the UK customs declaration process. Specific requirements may vary based on the nature of goods, trade agreements, and customs regulations.

- Register with HM Revenue & Customs (HMRC). To obtain your unique identifier for customs clearance you will need to register on the UK Government official website and apply for a GB EORI number if you are moving goods to or from Great Britain.

- Determine the appropriate Customs Procedure Codes (CPCs). Identify the correct Customs Procedure Codes that apply to the products you are importing or exporting. Refer to the UK Trade Tariff to determine the specific CPCs you need.

- Collect and submit required documentation

- Rules and restrictions

- Tax and duty rates

- What exporting documents you need

Use the Trade Tariff tool to find the correct commodity code to classify your goods and pay the right amount of Customs Duty and import VAT.

Attach a commercial invoice, which must include the following:

- Sender details

- Receiver details

- Content of the package in detail (quantity, weight origin)

- Tax ID/VAT

- EORI Number

- Tracking number

- 8-digit HS Code also known as Commodity Code

- Shipping details and exporting reason

- Sender’s signature and date

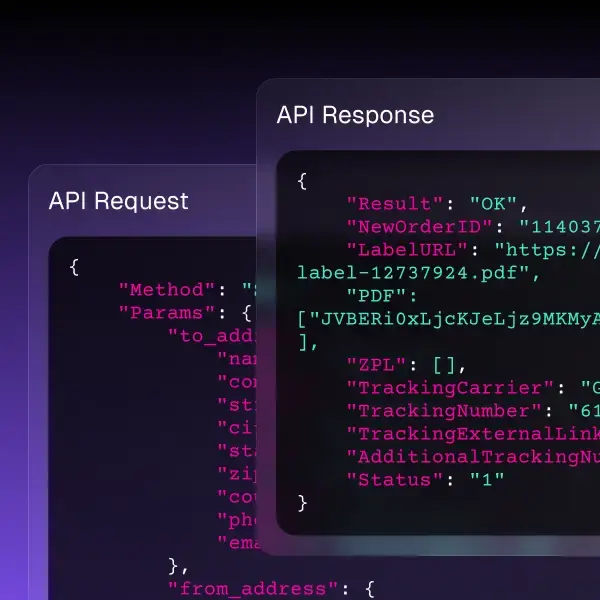

Electronic customs declarations and utilizing the Customs Handling of Import and Export Freight (CHIEF) system

HMRC handling of Import and Export freight CHIEF is being replaced by CDS (Customs Declarations Service) to ensure compliance with EU customs requirements. The CDS system is designed to be a more modern and cost-effective system for businesses to use. The last day for making import declarations through CHIEF was 30 September 2022, whereas the last day to submit export declarations on CHIEF will be 30 November 2023, when it will close.

To find out more about the main differences between the CHIEF and CDS system check HMRC’s official guide.

Post-Brexit changes and considerations

After Brexit, there have been significant changes for businesses involved in international trade, making customs declaration procedures far more complicated for them. As already mentioned, attaching the appropriate documentation is crucial to avoid unpleasant surprises for you and your customers.

A WMS system can provide valuable assistance for businesses in navigating post-Brexit changes, simplifying most procedures. By generating and managing all necessary customs documentation, such as commercial invoices, transport documents, as well as storing essential data on product descriptions, product values and country of origin, it can help stay on top of these complex tasks.

Conclusion

Merchants who ship to and from the UK have to now face additional administrative obligations in their operations, in order to comply with new regulations.

ShippyPro has identified the main challenges of post-Brexit trading and has developed a series of solutions for merchants, allowing them to ship internationally in a stress-free and simpler way.

Streamline your international shipping processes and overcome all challenges with the guidance of our experts. Book a call today.

FAQs

How has Brexit affected customs procedures and declarations for international shipments to the UK?

The main changes that impacted international shipments after Brexit are connected to customs procedures and declarations. In short you will now need to:

- Attach customs declarations documentation

- Pay duties and taxes

- Apply VAT

- Comply with specific Rules of Origin

- Adhere to specific regulations regarding the nature of the goods you are importing or exporting

What documentation and information do I need to prepare for customs declarations in the UK?

You will need:

- A commercial invoice

- The correct HS Code

- An EORI number

- Customs documents (CN22 or CN23 form)

How are customs values and tariff classifications determined for international shipments?

Tariff classification is done according to the Harmonized System (HS), according to which each product is assigned a unique HS code to determine the applicable customs duties and requirements.

Passionate freelance copywriter, with a niche in ecommerce and logistics. When collaborating with ShippyPro, she loves writing about trends, marketing and communication strategies to help brands gain an edge in an ever-evolving digital landscape.