How to Fix FedEx Error 'CUSTOMS.VALUE.INVALID': The Ultimate UK Guide

By

Ashley Brown

·

3 minute read

By

Ashley Brown

·

3 minute read

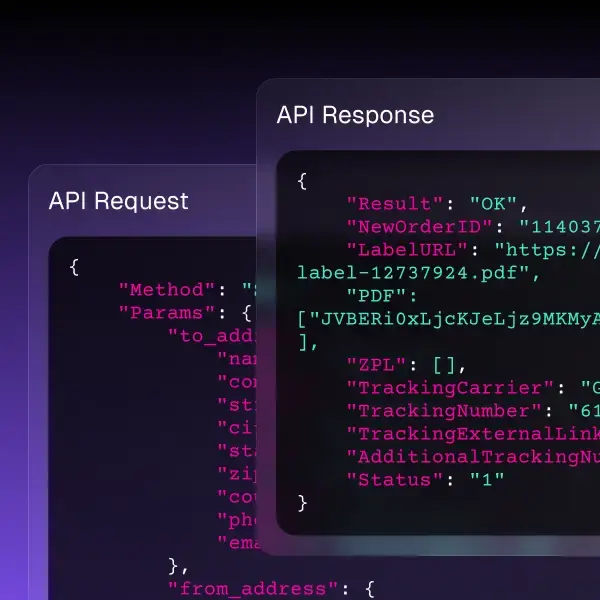

The FedEx Error CUSTOMS.VALUE.INVALID is a data validation failure that occurs when a shipment's declared value is missing, incorrectly formatted, or mathematically inconsistent with the commercial invoice. It acts as a mandatory compliance gatekeeper for HMRC regulations and international trade laws. This error is critical because it halts label generation, delaying global fulfillment and cross-border trade.

The 'CUSTOMS.VALUE.INVALID' error typically stems from a mathematical mismatch between the Total Declared Value and the sum of individual Unit Values in your manifest. For UK merchants in the 2026 post-Brexit landscape, this is frequently triggered by missing currency codes (failure to specify GBP) or entering a "0" value for warranty replacements or gifts. Platforms like ShippyPro resolve this by automatically synchronizing SKU values from your shop with the FedEx API, ensuring the mathematical totals always satisfy customs logic.

1. Understanding the 'CUSTOMS.VALUE.INVALID' Rejection

This is a hard rejection from the FedEx API. It indicates that the electronic data transmitted does not meet the legal minimum for international clearance. In the UK, this refers specifically to the Customs Value—the price paid for the goods when sold for export.

Semantic variations include "Invalid Customs Declared Value" or "FedEx Error 1000: Customs Value Required." Without resolving this, your shipping label cannot be generated, causing immediate bottlenecks in your warehouse.

Check our help center for other Fedex Errors

2. Common Causes & Step-by-Step Fixes

Step 1: Verify the Mathematical Sum

Review your order data to ensure that:

$$(Quantity \times Unit Value) = Total Customs Value$$

If there is a discrepancy of even £0.01 (often caused by rounded discounts in Shopify or Magento), the FedEx API will reject the request.

Step 2: Validate ISO Currency Codes

Ensure your shipping software is passing the correct ISO 4217 code. For UK-based accounts, this is GBP. If the field is blank or contains a symbol (£), the FedEx system cannot process duty calculations.

Step 3: The "Zero Value" Replacement Trap

Sending a replacement part under warranty for "Free" is a common error. HMRC requires a value for tax purposes.

- Solution: Declare the "Cost of Production" or "Fair Market Value." Never leave the field at £0.00.

Step 4: Sanitize Numeric Fields

The FedEx API expects clean data. Ensure your value fields do not contain:

- Currency symbols (£, $, €).

- Commas as thousands separators (use 1200.00 instead of 1,200.00).

- Trailing or leading spaces.

Step 5: Audit HS Codes and Country of Origin

A value error can sometimes be a "ghost" error caused by a missing HS Code or Country of Manufacture. If FedEx cannot classify the item, it cannot validate if the declared value is appropriate for that commodity.

2026 UK Guide to Harmonised System (HS) Codes.

3. Comparison: Commercial vs. Customs Value

| Feature | Commercial Value | Customs Value |

|---|---|---|

| Primary Use | What the buyer paid. | Basis for Duties and Import VAT. |

| Shipping Costs | Usually excluded. | Often included (CIF/DDP). |

| FedEx API Sensitivity | Low. | Extremely High (Primary Error Source). |

If you offer "Buy One Get One Free" deals, your e-commerce platform may send a £0 value for the free item. To bypass the FedEx error, use ShippyPro Rules to distribute the discount proportionally across all SKUs, ensuring every item has a non-zero value.

4. Why ShippyPro is the Ultimate Solution

Manual data entry is responsible for 95% of CUSTOMS.VALUE.INVALID errors. ShippyPro acts as an intelligent middleware between your store and FedEx:

- Auto-Calculation: ShippyPro automatically sums unit values to generate the exact total the FedEx API requires.

- Incoterm Mapping: It correctly maps DAP (Delivered at Place) or DDP (Delivered Duty Paid) so FedEx knows who pays the taxes and if they are included in the value.

- Electronic Trade Documents (ETD): It transmits value data digitally, eliminating the risk of lost paper invoices or data mismatches.

How to manage your ETD Documents in ShippyPro.

5. 2026 Market Data & Logistics Statistics

- 35% of international UK shipments are delayed due to inconsistent customs data.

- ShippyPro users see a 92% reduction in API validation errors through automated SKU mapping.

- The average admin cost for a shipment "held" in customs due to value errors is £25 per parcel.

- In 2026, data precision is the #1 factor in maintaining "Trusted Trader" status for UK exporters.

6. Frequently Asked Questions

Can I put £0.00 for a gift?

No. HMRC and FedEx require a value. Use the "Transaction value of identical goods" or the manufacturing cost.

Does the customs value need to include shipping?

This depends on the Incoterms. For some duty calculations (like CIF), shipping and insurance are part of the taxable value.

Understanding Incoterms 2026 for UK Sellers.

How do I fix this for 50 orders at once?

In the ShippyPro "To Ship" panel, select all orders with errors, click "Bulk Edit," and update the customs currency or values in one click.

Is "Customs Value" different from "Insured Value"?

Yes. Customs value is for tax; insured value is the recovery amount if lost. Use ShippyPro to set these independently to save on insurance premiums.

7. How to Start Exporting Error-Free

- Connect FedEx in your ShippyPro Carriers tab.

- Upload your SKU Library: Ensure every product has an HS Code, weight, and default value.

- Set Automation Rules: Flag any international order with a £0 value for manual review before the label is printed.

- Test a Label: Verify that data flows correctly from your shop to the FedEx API without rejections.

As the Growth Manager at ShippyPro, I help online retailers transform their shipping operations from a bottleneck into a growth engine. My expertise lies in ecommerce logistics and automation, specifically helping brands save time and scale efficiently. I write about the tools, strategies, and technologies that are defining the future of fulfillment.