What is an EORI Number? The 2026 Expert Guide to Customs Compliance

By

Ashley Brown

·

5 minute read

By

Ashley Brown

·

5 minute read

Is Your Shipment Stuck at the Border? Start Here. If you are reading this, you might already be facing a "held at customs" notification. In the post-Brexit landscape of 2026, the EORI number (Economic Operator Registration and Identification) has become the single most critical data point for international trade.

It is no longer just a bureaucratic formality; it is the "passport" that allows your goods to move between the UK, the EU, and the rest of the world. Without it, your inventory stops moving, but your storage fees keep running.

We wrote this guide because the rules have changed. It is no longer enough to have one number. From the "Double EORI" requirement for cross-channel trade to the specific "XI" protocols for Northern Ireland, compliance has become a complex web of acronyms. This article cuts through the noise, providing a technical roadmap for logistics managers to validate their status, apply correctly, and ensure their cargo never gets flagged for a missing ID again.

- The "No EORI, No Ship" Rule: Customs authorities (HMRC & EU) will block any commercial shipment lacking a valid EORI number.

- The "Double EORI" Requirement: Post-Brexit, most UK businesses trading with Europe need two numbers: one GB (UK) and one EU-based (e.g., FR or IT).

- VAT $\neq$ EORI: While often linked, your VAT number is for taxes; your EORI is for security and tracking. You cannot use them interchangeably.

- Northern Ireland (XI) Protocol: Shipping to/from Northern Ireland requires a specialized XI EORI number, distinct from your GB number.

What is an EORI number?

An EORI (Economic Operator Registration and Identification) number is a unique alphanumeric ID used by customs authorities throughout the European Union and the United Kingdom to track and secure shipments.

Think of it as the "Passport" for your cargo. Just as a traveler cannot enter a country without a passport, your goods cannot clear customs without an EORI. It allows authorities to identify exactly who is importing or exporting goods and check their security record.

Why do you actually need it?

- Avoid Storage Fees: Goods without an EORI are held at the border. Ports charge daily storage fees that can destroy your margin.

- Claim VAT Refunds: You cannot reclaim Import VAT on your tax return without a valid EORI linked to the import entry (C79 certificate).

- The Problem: You have no physical presence in the EU.

- The Solution: You must appoint an Indirect Customs Representative or Fiscal Representative. This local entity applies for the EORI on your behalf and shares liability for the customs debt.

- CDS Access: In the UK, your EORI is your login key for the Customs Declaration Service (CDS), which replaced CHIEF.

-2.png?width=1080&height=1350&name=(Italian)-2.png)

The "Double EORI" Trap

One of the most common errors we see in 2026 is assuming one number covers everything. Since Brexit, the UK and EU are separate customs territories.

The "Two-Number" Strategy:

If you are a UK brand storing stock in a French warehouse (3PL) to fulfill EU orders, a GB EORI is not enough.

- Exporting from UK: You need a GB EORI to clear UK Customs.

- Importing into France: You need an EU EORI (e.g., FR...) to clear French Customs.

Without both, your stock transfer will fail.

Region

Format Structure

Example

Use Case

Great Britain (GB)

GB + 9-digit VAT + 000

GB123456789000

Imports/Exports in England, Scotland, Wales.

Northern Ireland (XI)

XI + 9-digit VAT + 000

XI123456789000

Moving goods between GB and NI (Windsor Framework).

European Union (EU)

Country Code + Unique ID

FR1234567890123

Imports/Exports within any EU member state.

Non-VAT Registered

GB + "Pseudo" ID

GB098765432000

Micro-businesses under the VAT threshold.

How to Apply ?

Scenario A: UK Businesses (HMRC)

Applying is digital and instantaneous.

- Portal: Go to GOV.UK/eori.

- Prerequisites: Have your UTR (Unique Taxpayer Reference), Start Date, and SIC code ready.

- VAT vs. Non-VAT: If you are VAT registered, you must link the EORI to your VAT number. If not, you apply as a "Non-VAT registered importer."

- Timing: Instant (automated) or up to 5 working days if manual checks are triggered.

Scenario B: International Businesses (US, China, etc.)

If you are a US company acting as the "Importer of Record" in Europe (e.g., selling DDP), you cannot apply directly.

💡EXPERT TIP: The "XI" Number

If you apply for a GB EORI, you should simultaneously tick the box for an "XI" number if there is any chance you will trade with Northern Ireland. Getting them both at once saves weeks of administrative delay later.

How to validate a partner's EORI

Before handing your cargo to a carrier, validate the receiver's EORI. If their number is invalid, the carrier will return the goods to you at your expense.

Enter an EORI number to validate its format. This tool checks against UK (GB/XI) and EU patterns.

Troubleshooting: "My EORI is Invalid!"

If the validator rejects your number:

- Check the Database Mismatch: Are you checking a GB number in the EU database? They are not connected.

- Check the "000" Suffix: Many ERP systems cut off the final three zeros. Ensure the full 12-15 digits are transmitted to the carrier.

- New Registration Lag: It can take 24–48 hours for a newly issued number to propagate to the central database.

Get an estimate of customs duties and taxes for your shipment. Enter your product details below.

*This is an estimate. Final costs depend on carrier handling fees and exact HS classification.

EORI vs. VAT vs. HS Codes

This is where most errors happen. Here is the definitive distinction:

- EORI Number: "Who is moving the goods?" (Security & Operator ID).

- VAT Number: "Who pays the tax?" (Fiscal ID).

- HS Code: "What are the goods?" (Product Classification).

You need all three on a Commercial Invoice.

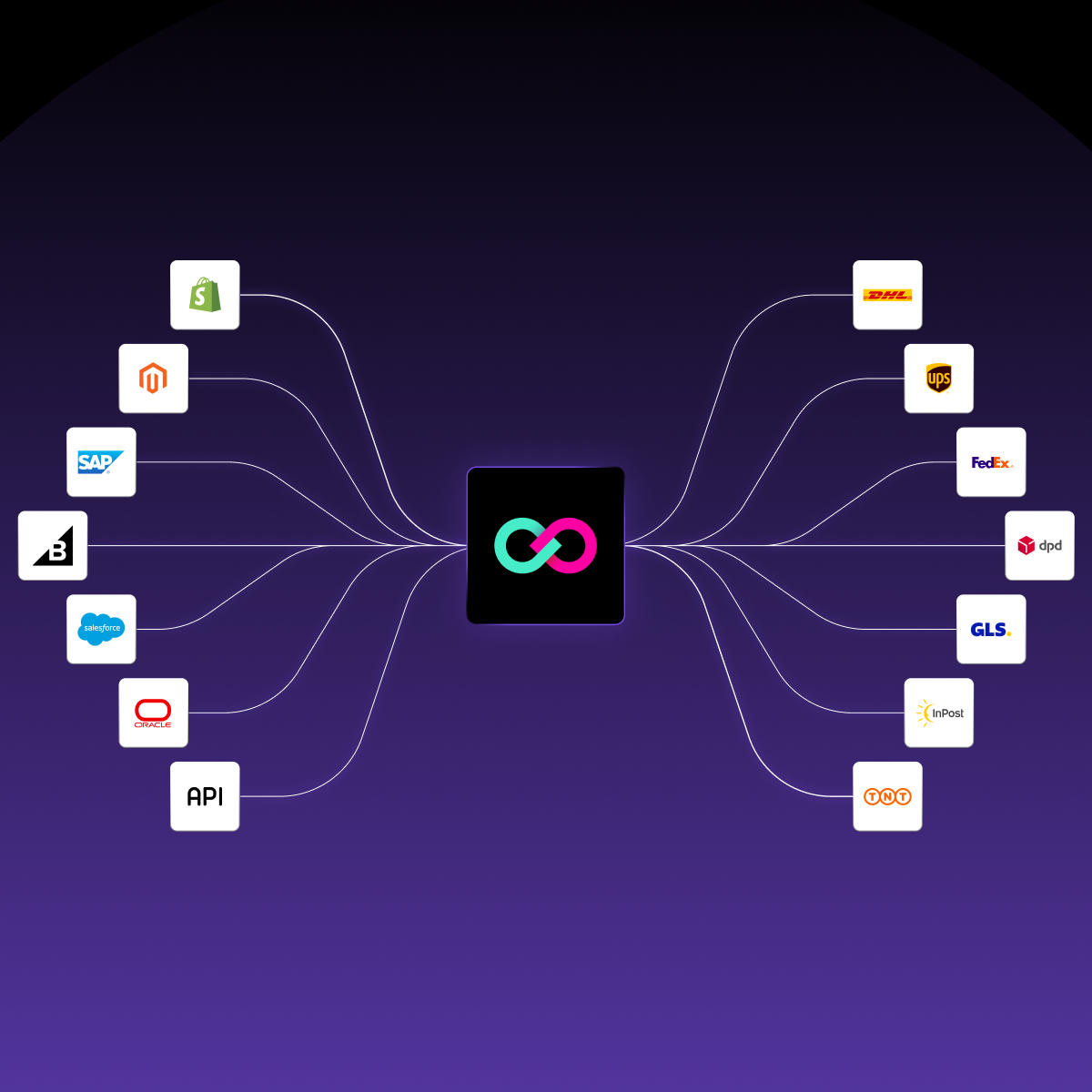

More tools for your shipments

FAQ on EORI Number

What is an EORI number and what is it used for?

An EORI (Economic Operator Registration and Identification) number is a unique alphanumeric ID used by customs authorities in the UK and EU to track and secure shipments. It acts like a "passport" for your cargo; without it, commercial goods cannot clear customs, leading to border delays and storage fees.

Do I need separate EORI numbers for the UK and the EU?

Yes. Since Brexit, the UK and EU are separate customs territories. If you export from the UK and import into an EU country (like France), you typically need both a GB EORI to clear UK customs and an EU EORI (e.g., FR or IT) to clear EU customs.

What is the difference between an EORI number and a VAT number?

A: While they often look similar, they serve different purposes. Your VAT number identifies "who pays the tax" (fiscal ID), while your EORI number identifies "who is moving the goods" (security & operator ID). You cannot use them interchangeably for customs declarations.

What is an XI EORI number?

An XI EORI number is a specialized identification required specifically for trading with Northern Ireland under the Northern Ireland Protocol. It is distinct from your standard GB EORI and typically follows the format XI + 9-digit VAT + 000.

Can a US or Chinese company apply for an EORI number directly?

Generally, no. If your business has no physical presence in the EU (e.g., a US company shipping DDP), you cannot apply directly. You must appoint an Indirect Customs Representative or Fiscal Representative to apply on your behalf, as they will share liability for the customs debt.

Why is my EORI number showing as invalid?

Common reasons for rejection include checking a GB number in an EU database (the databases are not connected) or your ERP system cutting off the final "000" suffix of the ID. Also, new registrations can take 24–48 hours to propagate to the central database.

Do I need an EORI number if I only ship documents?

No. If you only ship documents or letters, an EORI number is not required. It is mandatory only for commercial shipments of goods.

Get the 2026 Customs Compliance Toolkit

Don't risk a border blockade. Download our resource pack used by 15,000+ Logistics Managers to navigate post-Brexit rules.