New trade regulations impacting European supply chains in 2025

By

Giulia Castagna

·

8 minute read

By

Giulia Castagna

·

8 minute read

The largest trade regulation overhaul in EU history is set to reshape £2bn worth of supply chains across Europe. These sweeping changes affect everything from carbon emissions reporting to cross-border documentation requirements, creating unprecedented challenges for businesses operating in the EU market.

The largest trade regulation overhaul in EU history is set to reshape £2bn worth of supply chains across Europe. These sweeping changes affect everything from carbon emissions reporting to cross-border documentation requirements, creating unprecedented challenges for businesses operating in the EU market.

As a result of these new regulations, companies must adapt their supply chain operations, particularly regarding the Carbon Border Adjustment Mechanism (CBAM) and post-Brexit compliance requirements. Furthermore, businesses face strict deadlines to implement these changes, with significant penalties for non-compliance looming by 2025. Specifically, the new framework demands comprehensive emissions tracking, supply chain restructuring, and enhanced documentation processes across multiple industries.

EU unveils trade regulation changes

The European Union has unveiled extensive changes to trade regulations, affecting goods worth £2bn across multiple sectors. Under these modifications, businesses must adapt to stringent customs controls and new documentation requirements for imports from 31 January 2024.

How new rules reshape European commerce

The Trade and Cooperation Agreement (TCA) establishes zero tariffs and quotas for goods moving between the EU and UK, provided they meet the rules of origin requirements. Moreover, companies must demonstrate the 'economic nationality' of their products through substantial documentation, showing where materials and production processes originate.

The EU's Border Target Operating Model introduces mandatory pre-notifications for imports of animals, plants, and high-risk food products. Additionally, from 30 April 2024, documentary and physical checks will be conducted at Border Control Posts, focusing on medium and high-risk goods.

In essence, the EU manages trade relationships through comprehensive policies covering goods, services, intellectual property, public procurement, and foreign direct investment. The framework enables the EU to identify emerging challenges and react accordingly, thus maintaining its position as the primary trading partner for 74 countries worldwide.

Which industries face the biggest impact

Several key sectors are experiencing substantial changes due to the new regulations. Above all, manufacturers dealing with high-carbon steel exports to the EU must comply with new reporting requirements, with 84% currently unprepared for these obligations.

The automotive sector, food and beverage industry, and accommodation services face significant challenges due to their reliance on EU imports. At the same time, the chemical products industry and transport equipment manufacturers must adapt to increased exposure to trade shocks.

The implementation of the Carbon Border Adjustment Mechanism (CBAM) primarily affects industries producing:

- Cement

- Iron and steel

- Aluminium

- Fertilisers

- Electricity

- Hydrogen

The EU's services trade continues to show resilience, maintaining a surplus of £39.1 billion. In contrast, business and management consulting services have shown notable growth, whereas manufacturing and agricultural industries encounter additional paperwork and customs duties.

The European Commission has also proposed new e-commerce regulations to address the surge in low-value imports. These measures aim to protect consumer health and safety while ensuring fair competition for businesses. Subsequently, online marketplaces must implement user-friendly complaint mechanisms, cooperate with trusted flaggers, and follow strict advertising transparency rules.

For businesses engaged in cross-border parcel delivery, prices remain 3 to 5 times higher than domestic delivery rates. Consequently, about 62% of companies seeking to sell online identify high delivery costs as a significant barrier.

The new framework also introduces rules for digital contracts, establishing clearer rights for consumers accessing digital content and services. In due course, these changes will affect how businesses handle online transactions and manage customer relationships across the EU market.

CBAM forces companies to rethink Supply Chains

The Carbon Border Adjustment Mechanism (CBAM) compels businesses to fundamentally restructure their supply chains, marking a significant shift in European trade practises. Initially, this mechanism applies to imports of carbon-intensive goods, including cement, iron, steel, aluminium, fertilisers, electricity, and hydrogen.

Carbon Border Tax hits key sectors

The construction sector faces substantial impacts from CBAM, primarily because of its reliance on key materials like iron, cement, steel, and aluminium. Under these regulations, construction companies encounter increased costs related to carbon pricing and administrative requirements for data collection and compliance.

The energy and utilities sector experiences notable effects, chiefly through the inclusion of hydrogen within CBAM's scope. Likewise, the agricultural sector confronts challenges, especially regarding fertiliser imports, with production costs expected to rise significantly. Indeed, fertiliser accounts for 38% of crop-specific expenditure and 12% of total farm costs.

Companies scramble to calculate emissions

From October 2023 through December 2025, EU importers must submit quarterly CBAM reports within one month after each quarter's end. These reports must detail:

- Greenhouse gas emissions embedded in imports

- Direct and indirect emissions data

- Production methods and supporting documentation

Starting January 2025, a new portal section of the CBAM Registry enables installation operators outside the EU to upload and share their installations and emissions data with reporting declarants.

Supply Chain redesign becomes critical

The financial implications of CBAM are substantial, with carbon emissions emerging as a significant expense in global trade. For instance, with a carbon price of EUR 80 per tonne of CO2, the mechanism would generate EUR 14.7 billion in revenue yearly.

To ensure compliance and mitigate risks, companies must undertake several critical steps:

-

Conduct comprehensive supply chain mapping to identify affected suppliers

-

Update standard contracts to include clauses mandating accurate emissions data

-

Establish robust data collection and management systems

The impact varies significantly across nations, influenced by their emission intensity in production and domestic carbon pricing mechanisms. Notably, the import cost of Chinese aluminium products into the EU could increase by approximately 17%, whilst Indian aluminium products might face a cost increase exceeding 40%.

Companies failing to innovate and reduce their embedded emissions will encounter additional costs through mandatory CBAM certificate purchases. In fact, those who do not comply may lose market access entirely, as EU customers will have no choice but to shift away from non-cooperative suppliers.

Brexit complications add to regulatory burden

British businesses face mounting pressure as they grapple with dual regulatory frameworks following Brexit. Almost two-thirds of firms trading with the EU report increased difficulties compared to the previous year.

UK businesses navigate dual compliance

Law firms now advise clients affected by post-Brexit divergence to operate separate compliance policies and reporting systems for UK and EU operations. Since Britain's departure from the European Union, companies handling both UK and EU data must navigate relationships with multiple regulatory bodies, with 72% of businesses reporting interactions with both the Information Commissioner's Office and EU Data Protection Authorities.

The administrative burden has grown substantially, with 40% of UK companies noting increased complexity when managing compliance across both regions. Businesses must now complete detailed customs forms, export declarations, and commercial invoices for EU trade. Furthermore, 49% of exporters state the Brexit deal hinders their sales growth.

The complexities extend to VAT regulations, where businesses often need registration in destination countries, sometimes facing duplicate charges in both the UK and EU. Rather than simplifying, 41% of firms exporting under the Brexit deal encounter difficulties adapting to rules on buying and selling goods.

Northern Ireland protocol creates new challenges

The Northern Ireland Protocol, modified by the Windsor Framework in February 2023, introduces distinct operational challenges. Under these arrangements, goods moving from Great Britain to Northern Ireland must navigate a new system:

- Green lane: Products destined to stay in Northern Ireland face fewer controls

- Red lane: Items moving to Ireland or the EU require full checks and controls

Starting 13 December 2024, Northern Ireland faces additional changes to general product safety rules. Businesses must designate contact points in Northern Ireland or the EU to ensure compliance tasks are fulfilled and to inform authorities of safety incidents.

The Protocol's implementation affects various sectors differently. For agri-food products, the framework simplifies movement by requiring only a single certificate instead of multiple documents for each product. Nevertheless, 35% of firms trading services face difficulties under the Brexit deal, whilst 27% struggle with professional qualification recognition.

Presently, awareness of upcoming regulatory changes remains critically low, with 80% of firms lacking knowledge about new legislation. The situation becomes more complex as UK and EU regulations diverge, creating additional challenges for traders on both sides of the Channel. Ultimately, businesses must adapt swiftly to maintain market access, although the administrative complexity continues to affect profitability and operational efficiency.

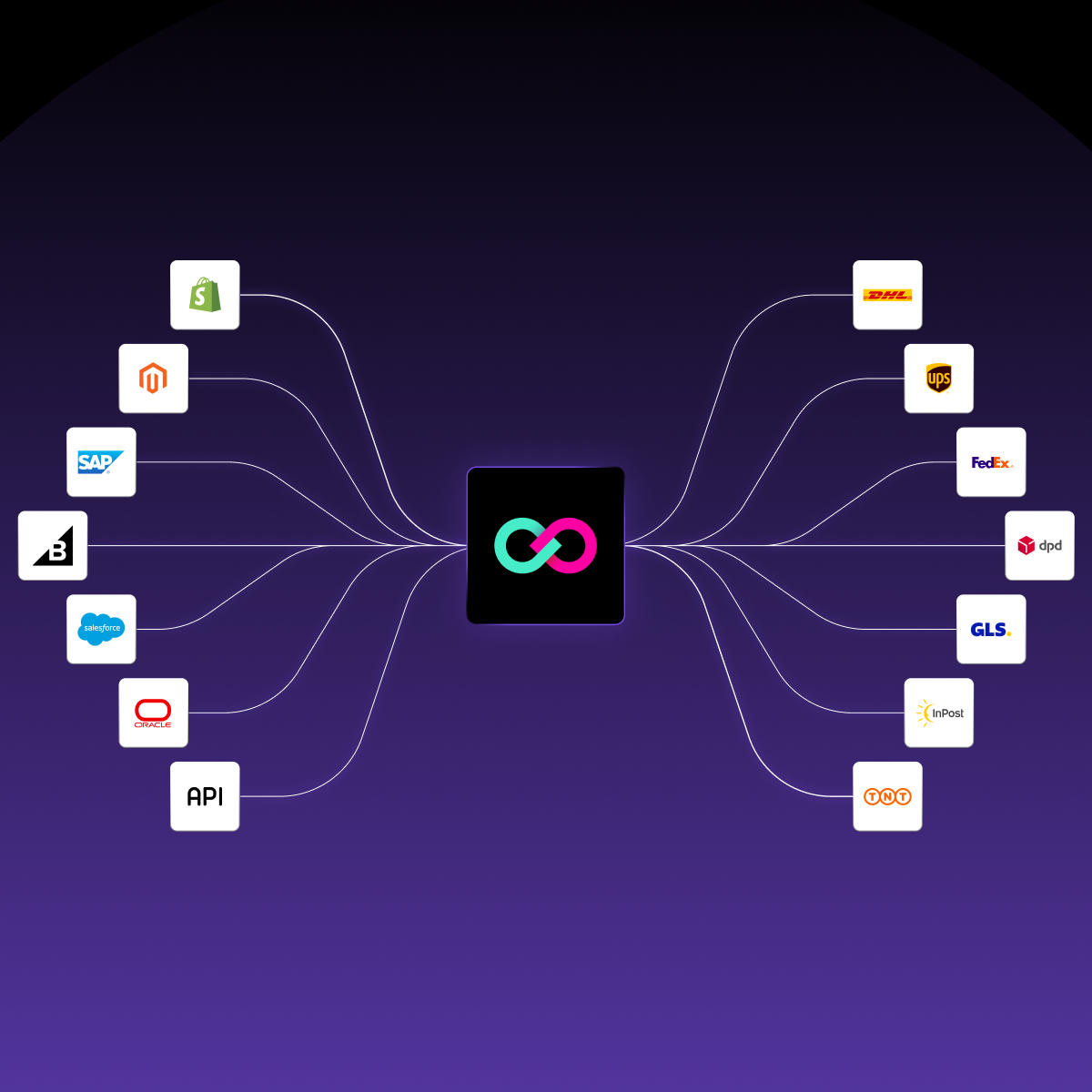

Technology solutions emerge to handle compliance

Innovative software solutions emerge as businesses seek efficient ways to manage complex trade regulations. These digital tools streamline compliance processes, automate data collection, and enhance supply chain visibility across European markets.

Digital platforms streamline documentation

Software as a Service (SaaS) platforms now offer centralised data management systems that maintain comprehensive compliance records. These solutions automate routine compliance tasks, minimising human error and reducing manual intervention requirements. Real-time updates ensure businesses operate with current regulatory information, promptly incorporating changes into their systems.

The European Union's Single Window initiative introduces a unified portal for customs formalities, enabling information exchange between all stakeholders. This digital solution allows businesses to complete border formalities through a single portal, generating substantial efficiency gains in goods clearance. Henceforth, economic operators benefit from automated document verification, often available 24/7, streamlining the clearance process even outside working hours.

AI Tools Help Calculate Carbon Costs

Artificial Intelligence has become instrumental in managing carbon footprint calculations and compliance reporting. AI-powered tools process vast amounts of compliance documents with unprecedented accuracy, detecting unusual patterns that might indicate non-compliance [3]. These systems analyse historical compliance data to predict potential issues before they arise.

Advanced carbon footprint calculators now incorporate four key components:

- Geographical location assessment

- AI application analysis

- Hardware and software resource evaluation

- Model selection optimisation

Machine learning algorithms analyse satellite images, government reports, and supplier data to automatically flag areas at risk of deforestation. Straightaway, businesses can address environmental concerns and maintain compliance with EU regulations. These tools save approximately 90% of time on emissions data collection whilst delivering 70% more accurate datasets.

Blockchain enables supply chain transparency

Blockchain technology offers a tamper-evident record-keeping system that provides trusted validation of transactions across complex supply chains [21]. This distributed ledger technology creates an immutable record of transaction data, enabling seamless exchange of value and establishing a single source of truth for all parties involved.

The technology strengthens global supply chains through:

- Enhanced visibility and traceability for critical components

- Increased data accuracy and trust among partners

- Improved risk prediction capabilities

Currently, blockchain interfaces with Internet of Things (IoT) devices and smart contracts to provide enhanced supply chain security. This integration enables real-time tracking of products and automatic verification of compliance requirements. Undoubtedly, blockchain improves supply chains by enabling faster and more cost-efficient delivery whilst enhancing product traceability.

These technological advancements help businesses adapt to evolving trade regulations. Through automated compliance tools, companies can maintain accurate records, streamline reporting processes, and ensure adherence to complex regulatory requirements across European markets.

Companies must act now to ensure readiness

Major regulatory changes affecting European trade demand immediate action from businesses as crucial deadlines approach. The European Union's deforestation regulation, originally scheduled for late 2024, now requires large companies to comply by 30 December 2025.

Key deadlines for 2025

The EU has established a phased implementation timeline for various trade regulations. Starting 1 January 2025, businesses importing carbon-intensive products must submit detailed reports based on EU-mandated methods. Therefore, companies must prepare for:

- Safety and security declarations for EU imports into Great Britain by 31 January 2025

- Updated Combined Nomenclature implementation from 1 January 2025

- CBAM Registry data sharing requirements for non-EU operators

Small and micro-enterprises receive additional time, with compliance deadlines extending to 30 June 2026. Meanwhile, the EU Commission has launched the EUDR Information System for submitting Due Diligence Statements through two platforms:

- Live server for legal documentation

- Training platform for practise submissions

Steps to achieve full compliance

To ensure readiness, businesses must undertake systematic preparation. First, companies should determine whether their activities fall under UK ETS or EU ETS jurisdiction. Soon after, organisations must obtain necessary permits for installations and emissions plans.

Essential compliance steps include:

-

Monitoring System Implementation: Establish robust tracking mechanisms for greenhouse gas emissions with regular reporting to regulators

-

Documentation Management: Maintain comprehensive records including:

- Commercial invoices

- Packing lists

- Certificates of origin

- Customs declaration forms

The EU has scheduled virtual training sessions throughout 2025 to support businesses with the EUDR Information System. Currently, companies must verify product classification and related duties using the EU's TARIC database.

For seamless operations, businesses should:

- Register for an EORI number through national customs authorities

- Calculate applicable duties, tariffs, and VAT rates

- Arrange proper transportation and delivery systems

Regarding emissions trading, companies must participate in ETS auctions to purchase necessary allowances. Afterwards, businesses need to surrender these allowances by specified deadlines to cover verified emissions from the previous year.

Conclusion

Sweeping changes across EU trade regulations demand swift action from businesses operating in European markets. These modifications affect everything from carbon reporting through CBAM to complex Brexit-related requirements, reshaping supply chains worth £2bn. Companies face strict deadlines, particularly regarding emissions tracking and documentation processes, with major compliance milestones approaching throughout 2025.

Technology offers practical solutions as businesses adapt to these regulatory demands. Digital platforms, AI-powered tools, and blockchain applications help streamline compliance processes, automate data collection, and enhance supply chain visibility. Though these solutions ease the administrative burden, businesses must still establish robust systems for monitoring emissions, managing documentation, and ensuring regulatory adherence.

British companies face additional challenges, navigating dual compliance requirements after Brexit while adapting to new trade frameworks. Success depends on thorough preparation, including comprehensive supply chain mapping, updated contract management, and efficient data collection systems. Companies that act decisively now position themselves advantageously for the evolving European trade landscape, while those delaying risk significant penalties and potential market access restrictions.

Read more about new trade regulations here:

- EU Regulation 2023/988 on General Product Safety: factsheet

- Application of EUDR Regulation on deforestation-free products delayed until December 2025

- Preparing for the new safety and security declaration requirements

- Navigating Post-Brexit Challenges: Compliance and Logistics for UK Businesses

Curious by nature, analytical by mindset, Giulia Castagna is the voice behind ShippyPro’s content. As Content Marketing Manager, she simplifies complex logistics topics for those who ship around the world every day. She writes about AI, automation, and shipping trends to inspire data-driven decisions.