Logistics Decarbonisation: how to reduce GHG emissions

Road transport is one of the main sources of greenhouse-gas emissions in the United Kingdom. According to the Department for Transport and the Department for Energy Security and Net Zero, in 2022 the transport sector accounted for 28 % of the country’s total GHG emissions, and roughly 89 % of that came from road vehicles.

Across Europe, road transport contributes about 72 % of CO₂ emissions in the transport sector. In the UK, 81 % of domestic freight moves by road, while rail carries about 7 % (the remainder travels by water).

The transport sector is also a major source of local pollutants: in 2022 it generated 18 % of national PM10 emissions.

Environmental impact of logistics in Europe

CO₂ emissions from road transport

In 2020 transport generated about 25% of the EU’s total greenhouse-gas emissions, with road transport responsible for roughly 72% of the sector’s output.

The role of freight transport in urban pollution

Freight transport contributes significantly to pollution in urban areas. The transport sector generates a large share of PM10 particulate emissions, with road transport making up a substantial part.

Growing demand for goods in cities has led to environmental and economic costs linked to more vehicle-kilometres, congestion and parking pressure. The boom in e-commerce has changed consumer expectations, driving a sharp rise in deliveries.

Forecasts suggest that, globally, carbon emissions from deliveries could grow markedly by 2030, representing a sizeable share of transport-sector and overall city emissions.

Increasing regulatory and social pressure

Regulatory and social pressure is steadily mounting. The EU aims to cut net GHG emissions by at least 55% versus 1990 levels by 2030.

For heavy vehicles the new rules call for a 45% reduction by 2030, 65% by 2035 and 90% by 2040. For new urban buses the target is 90% zero-emission by 2030 and 100% by 2035.

The EU Emissions Trading System has been expanded with EU ETS2, which now covers road transport—evidence of the growing commitment to decarbonise the sector.

Technologies for logistics decarbonisation

Electric vehicles for urban deliveries

Electric vehicles are an ideal solution for last-mile deliveries, especially in cities. With zero tailpipe emissions they can enter low-emission zones without restriction. Their compact size suits narrow streets and their range can reach 200 km with fast-charging systems.

Well suited to stop-and-go operations, EVs also deliver significant savings in operating and maintenance costs. Many companies are already adopting the technology.

Biofuels and sustainable aviation fuel (SAF)

Biofuels offer a practical alternative to petroleum derivatives. SAF, produced from renewables such as vegetable oils and animal fats, can cut GHG emissions by up to 80% compared with fossil fuels.

Hydrogen decarbonisation for heavy-duty vehicles

Hydrogen is emerging as a promising option for heavy transport. Fuel-cell vehicles convert the chemical energy of hydrogen into electricity, emitting only water vapour. They offer ranges up to 800 km and quick refuelling, making them ideal for long haul.

The EU’s AFIR regulation calls for a hydrogen refuelling station every 100 km along the TEN-T core network by 2027.

Digitalisation for route optimisation

Digitalisation is a cornerstone of emissions reduction. Advanced software plans optimised routes that consider operational constraints and time windows.

Real-time tracking systems monitor the entire transport process, give all stakeholders visibility and digitise document flows. These technologies can significantly lower transport costs and related emissions.

Barriers to the sector’s green transition

High upfront costs for businesses

The purchase price of electric heavy-duty vehicles is a major deterrent, mainly because of battery costs. Studies predict that by 2035 new electric trucks will be cheaper to own and operate than diesel ones, but companies still face high upfront outlays today.

Insufficient charging infrastructure

Electric penetration in freight transport remains limited partly due to inadequate infrastructure. Meeting EU targets will require many fast-charging points. A 150 kW charger is expensive, excluding civil works and installation. Firms also report difficulties securing power capacity and timely installation approvals.

Charging times and range limits

Electric trucks have significant range limits—200 to 500 km per charge versus up to 1,000 km for diesel. Charging times vary widely: 2.5 to 11 hours depending on power availability, or 2–4 hours at 150 kW to go from 10 % to 100 %. These constraints affect operational efficiency, especially on long runs and tight schedules. Uneven infrastructure across EU countries hampers cross-border planning.

Lack of uniform European standards

International freight transport needs shared rules across member states. The absence of common technical standards for infrastructure, taxes and green incentives can distort the market and cause carbon leakage.

Perceived regulatory preference for battery-electric traction has drawn criticism from some industries that call for greater support for alternatives such as synthetic fuels, advanced biofuels and green hydrogen.

Strategies and roadmap for meeting EU standards

EU targets: –45% emissions by 2030

Under the Green Deal and the 2050 climate-neutral goal, the EU mandates these road-transport cuts:

- –45 % CO₂ from heavy-duty vehicles by 2030

- –65 % by 2035

- –90 % from 2040

These targets form part of the Fit for 55 package, which also revises the Renewable Energy Directive (RED III), extends EU ETS2 to road-fuel use and sets AFIR rules on alternative-fuel infrastructure.

Avoid – Shift – Improve (ASI) approach

To speed up logistics decarbonisation, the European Commission promotes the ASI model:

- Avoid: cut unnecessary trips by optimising urban logistics, consolidating loads and supporting local production.

- Shift: move freight from polluting modes (road) to greener ones such as rail, inland waterways or intermodal solutions.

- Improve: boost vehicle and technology efficiency through digitalisation, alternative fuels and low-emission fleets.

This integrated approach is also recommended by the OECD’s International Transport Forum.

Tax incentives and public funding

In 2023-25, the UK government has allocated more than £580 million for sustainable mobility, including:

- £381 million from the Local Electric Vehicle Infrastructure (LEVI) Fund to accelerate the installation of public charging points across England.

- £200 million for the Zero-Emission HGV & Infrastructure Demonstrator Program to introduce up to 370 zero-emission trucks and 57 dedicated charging or refueling stations.

At EU level, the Connecting Europe Facility (CEF) and the Innovation Fund support alternative fuels, hydrogen and smart logistics.

Additional smaller funds support innovation through the Freight Innovation Fund and local grants.

Measuring carbon footprint along the supply chain

With the Corporate Sustainability Reporting Directive (CSRD), large companies must disclose environmental impact under ESRS standards and the GHG Protocol.

Monitoring Scope 3 emissions—indirect emissions from the supply chain (transport, procurement, use and end-of-life)—is crucial, as these often exceed 90 % of total footprint.

Tools like CarbonCare and EcoTransIT let firms calculate shipment impact under EN 16258, facilitating ESG reporting.

Conclusion

Logistics decarbonisation is no longer optional; it is a strategic necessity for complying with EU standards and maintaining long-term competitiveness.

Transport—especially road haulage—remains a major source of climate-altering emissions. The technologies exist, from electric vehicles to hydrogen, biofuels and digitalisation, but uptake is slowed by structural, economic and regulatory barriers.

Overcoming these barriers requires a systemic approach that combines:

- Public investment and private incentives

- Common EU-wide standards

- Transparent measurement of carbon footprints

- Collaboration among businesses, institutions and citizens

The journey toward decarbonised logistics is long and complex but offers tangible benefits: medium-term cost reductions, easier access to ESG funds, more resilient supply chains and a sustainable reputation.

Acting today means building the competitive advantage of tomorrow.

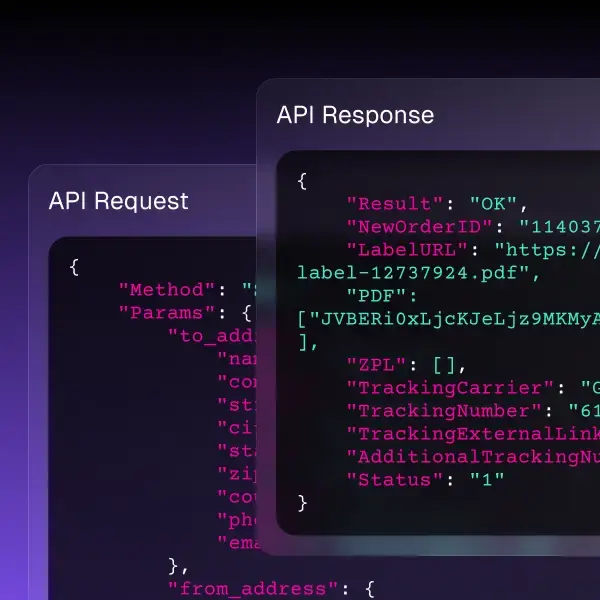

ShippyPro is the complete shipping software for online and offline retail. With Label Creator, Track & Trace, Easy Return and Analytics features, our software simplifies your shipping operations. ShippyPro integrates with over 180 carriers and 80 sales channels, making it compatible with a wide range of products and use cases.