ROI of Shipping Analytics: How to Calculate Your Payback

Most teams feel the pressure from three sides: rising parcel costs, tighter SLAs, and customers who expect accurate ETAs and painless returns. The question isn’t whether to invest in shipping analytics; it’s how to prove the payback.

When you quantify the economics behind delivery performance — from cost per shipment to exception rates — the path to ROI becomes visible. You’ll see where spend leaks, which couriers outperform on specific lanes, and how service issues erode repeat purchase. In short, analytics gives you levers the P&L can feel.

This guide walks you through how to calculate shipping analytics ROI step by step so you can stop guessing, start proving, and make your shipping stack pay for itself.

By analysing invoices and courier data, teams can uncover cost leaks, improve SLA compliance, and enhance customer experience through fewer delays and WISMO contacts. The result: measurable gains in efficiency, savings, and customer retention.

What Shipping Analytics is (and isn’t)

Shipping analytics is not a dashboard for its own sake. It’s an operating system for decisions that blends invoice normalisation, lane‑level performance benchmarking, and exception triage into one picture of cost‑to‑serve. In practice, analytics tools are designed to expose courier performance and cost discrepancies so managers can act in‑week, not after month‑end.

It isn’t a replacement for procurement, CS, or ops expertise. It augments them with facts you can negotiate and plan with especially when couriers’ reports don’t match your lived reality in peak.

Why shipping analytics ROI matters (and where the value hides)

Logistics leaders are still wrestling with the economics of the last mile, which is often the largest single cost component in fulfilment. Research associates last‑mile with roughly 65% of logistics costs [Last-mile Experts], making targeted improvements highly monetisable.

There’s also headroom for gains: McKinsey estimates that digital supply chain and analytics can cut operational costs by up to 30%, a useful boundary when setting expectations for the upside — especially when improvements focus on transport, network, and routing decisions.

Finally, the customer lens matters. Surveys indicate that poor delivery experiences materially reduce repeat purchase intent; in one multi‑country study, most shoppers reported late shipments and many were less likely to buy again after a poor online experience. Reducing exceptions is therefore both a cost and a revenue lever.

Three tangible outcomes (cost, SLA, customer experience)

First, cost. Analytics surfaces unnecessary spend: from misapplied surcharges to inefficient service selection. Even a modest reduction in surcharges across your top lanes compounds quickly at volume.

Second, SLA. Visibility into transit times by lane and service lets you rebalance courier allocation to lift on‑time performance without over‑paying for speed you don’t need. That stabilises promises and reduces make‑good credits.

Third, customer experience. Fewer exceptions mean fewer “Where Is My Order?” contacts, fewer refunds for delay, and higher repeat purchase intent. Tie operational improvements to measurable drops in WISMO and returns to show revenue protection.

How to calculate shipping analytics ROI: a practical framework

Establish your economic & operational baseline

Start with a time‑boxed baseline, ideally the last 90 days. Rebuild cost per shipment from the invoice up: base rate, fuel, remote area, address correction, re‑weigh, and any bespoke fees. Pair this with service metrics: on‑time rate, exceptions per 1,000 shipments, average transit time by lane, first‑attempt delivery success, and WISMO contacts per 1,000 orders. Lock this dataset; it’s your “before”.

Identify the value drivers

Not every lever pays the same. Typical value drivers include:

- surcharge recovery or prevention (address hygiene, weight accuracy);

- courier mix optimisation by lane;

- service re‑mapping against promised ETAs;

- proactive exception workflows that reduce re‑delivery and refunds;

- contact deflection via better tracking and notifications.

The financial model: ROI, Payback, NPV, IRR

Finance teams read models, not anecdotes. Express benefits as cash flows: recurring monthly savings (opex reduction), one‑off recoveries (credits), and revenue protection (reduced refunds). Then calculate:

- ROI (%) = (Annual Net Benefit ÷ Annualised Cost) × 100.

- Payback (months) = Total Investment ÷ Monthly Net Benefit.

- NPV/IRR: Discount the net cash flows at your WACC to show value beyond payback.

Anchor assumptions to your baseline, and cap each lever with conservative, realistic ranges.

Metrics that feed the payback calculation

Your CFO will ask “what drives the number?”. Answer with a short list that maps to cash:

- Cost per shipment (all‑in) and surcharge rate per parcel.

- On‑time delivery rate and exceptions per 1,000 shipments.

- First‑attempt delivery success and re‑delivery rate.

- WISMO contacts per 1,000 orders and cost‑to‑serve per contact.

- Refunds/discounts due to delay or damage (% of orders; £ impact).

- Revenue at risk from poor delivery experience (proxy via repeat‑rate/NPS).

💡Step‑by‑step methodology

1) Build the baseline and align it

Reconcile three data sources: order/parcel data, courier invoices, and tracking events. Normalise them so every shipment has a unique key and a comparable cost breakdown. Socialise a one‑page “as‑is” with Finance to align definitions before modelling.

2) Quantify each lever conservatively

Run controlled tests: e.g., re‑rate last month’s volume using an alternative service on the top five lanes; simulate address validation on a subset to estimate avoided surcharges; quantify how a 2‑point on‑time lift reduces refunds. Use p50/p10/p90 savings to reflect uncertainty.

3) Model costs and time‑to‑value

Include platform fees, implementation, data work, and process change. Separate one‑off vs recurring. Phase benefits to reflect adoption (e.g., 50% of target in Q1, 80% in Q2).

4) Calculate ROI and payback; publish the “benefits waterfall”

Turn test results into monthly cash flows, then compute ROI and payback. Present a waterfall from baseline cost to net run‑rate with labels for each lever so stakeholders see what’s doing the work.

Ongoing impact measurement (post go‑live)

Keep the model alive. Convert your ROI sheet into a monthly scorecard that tracks: realised savings vs plan; on‑time; exceptions; refunds; WISMO; and any negotiated rate changes. Highlight variance, document root causes, and adjust playbooks (for example, re‑weight lanes if a courier slips below threshold).

Common pitfalls to avoid:

- Double‑counting benefits (e.g., counting both fewer exceptions and lower refunds for the same orders).

- Mixing hard savings with cost avoidance without labelling.

- Ignoring implementation drag: benefits ramp over months, not days.

- Benchmarking with noisy data (unreconciled invoices, missing events).

- Treating analytics as a one‑off project rather than a run‑rate capability.

Tools that make the maths easier: ShippyPro Optimizer

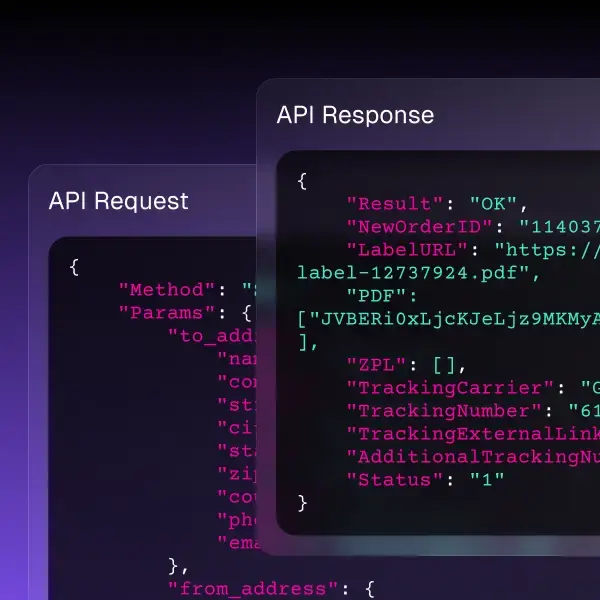

To operationalise the model you need trustworthy data, flexible filters, and exports.

ShippyPro Optimizer provides couriers and costs dashboards so you can monitor average transit time, on‑time performance, and total shipment cost by courier, country, or period: ideal inputs for your baseline and benefits tracker.

- Need to slice data outside the UI? You can export up to 100,000 shipments to CSV from Optimizer, making it simple to run cohort analyses and share evidence with finance.

- Proactive communication matters: SMS and email tracking notifications reduce “Where is my order?” contacts and help lift first‑attempt success. Another lever in your ROI stack.

- For a wider look at metrics that typically feed these models, see our overview on shipping analytics tools and KPIs.

Yes, you could build this from scratch. Or you could let Optimizer do the heavy lifting and just walk into your next review with proof.

Conclusions

Shipping analytics pays when it turns insight into action: cleaner invoices, smarter carrier choices, fewer exceptions, and steadier promises. Put a number on each lever, pressure‑test it, and keep measuring after go‑live.

That’s how analytics graduates from dashboard to P&L impact.

More on Shipping Analytics

ROI of Shipping Analytics: FAQs

What’s a realistic payback horizon for shipping analytics?

For mid‑volume ecommerce operations, 3–9 months is common when you capture surcharge prevention and improve on‑time rates; more complex environments may run 9–12 months

How do I calculate ROI for shipping analytics?

You compare the annual benefits (e.g., fewer exceptions, lower redelivery costs, better courier rates) with the annual operating cost and initial investment. Then you compute ROI = (Annual Benefits − Annual Costs) ÷ Total Investment × 100 and payback period in months.

Which KPIs matter most for shipping analytics ROI?

Key metrics include on-time delivery (OTD), first-attempt success (FAS), re-delivery and exception rates, cost per shipment, WISMO contacts and customer satisfaction (CSAT/NPS). These reveal where money is leaking and where gains can be modelled.

What timeframe should I use for the baseline when modelling shipping analytics ROI?

Use a 6- to 12-month period covering representative volumes, lanes, couriers and service levels. That gives a stable “as-is” benchmark before modelling improvements and monitoring results.

How can I prove the uplift from a shipping analytics project?

Run a controlled test: apply the analytics initiative in a subset (e.g., specific lanes or stores) and compare results before and after — measure FAS, OTD, exceptions and cost per shipment. Confirm the increases before scaling.

What makes savings from shipping analytics “bankable” for the CFO?

Savings become credible when you align assumptions with clearly defined metrics, model sensitivity (±10 % for example), track actual monthly benefits, assign ownership and reconcile modelled versus real savings. Then finance views them as investible.

How often should I track and report benefits from shipping analytics?

Monthly monitoring is ideal. Publish dashboards showing cumulative savings vs plan, courier performance by lane, exceptions by type, and CX metrics. Regular cadence keeps momentum and prevents slippage.

ShippyPro is the complete shipping software for online and offline retail. With Label Creator, Track & Trace, Easy Return and Analytics features, our software simplifies your shipping operations. ShippyPro integrates with over 180 carriers and 80 sales channels, making it compatible with a wide range of products and use cases.