Shipping to Europe from the UK: an updated guide for 2025

As an ecommerce retailer, you may have noticed that after Brexit, shipping to Europe from the UK has become more complex and slower. In fact, you now must treat your shipments as international ones, meaning you need to clear customs and provide the appropriate documentation if you don’t want to risk unpleasant surprises for you and your customers.

We are aware of the chaos and problems delayed parcels, undelivered orders or additional charges can cause to both parties, and this is why we’ve decided to write a detailed and simplified guide outlining which documents you need when you are shipping to Europe after Brexit.

Table of contents

- 4 prerequisites to ship to Europe in 2025

- VAT and clearing customs

- Shipping to Europe: carrier updates for 2025

- FAQs: shipping to Europe from the UK after Brexit

- Simplify the process

4 prerequisites to ship to Europe in 2025

To ship orders from the UK to the EU make sure you have:

- EU VAT registration (preferable if in your country of clearance)

- EORI Number

- Customs Declaration

The EORI Number

The EORI Number (Economic Operators Registration and Identification Number) is a unique ID number that businesses need when moving goods between EU and non-EU countries. If your business hasn’t already automatically obtained one. Click here to apply for a UK EORI number (beginning with GB) on the HM Revenue & Customs website.

The Commercial Invoice

When shipping to Europe after Brexit, the commercial invoice serves as a customs declaration for all items with commercial value and is necessary to give a detailed description of the goods and their value to authorities, thus determining more clearly which customs duties need to be paid and by who.

The invoice needs to be provided by the person or business shipping items internationally. If you are shipping to Europe from the UK, we recommend you include three printed copies of the commercial invoice: 1 attached to your parcel (for customs), 1 inside (for your customer), and 1 to keep yourself.

When you fill in a commercial invoice, remember to be as detailed as possible. Always include:

- Sender details

- Receiver details

- Content of the package in detail (quantity, weight origin)

- Tax ID/VAT

- EORI Number

- Tracking number

- 8-digit HS Code also known as Commodity Code / Tariff Code (Click here to discover the HM Revenue & Customs classification tool)

- Shipping details and exporting reason

- Sender’s signature and date

Remember that the commercial invoice and CN22 or CN23 are different documents. The latter is required for international shipments made with a national courier, as for exampleany shipment sent through Royal Mail containing items with a commercial value.

CN22 and CN23

Their purpose is the same as the commercial invoice, namely helping authorities to determine the customs duties and taxes to apply on your shipment. These documents are the most common customs declarations and are required when sending goods internationally through Royal Mail.

You do not need to use a CN22 or CN23 form when shipping with private carriers. However, if you are shipping to Europe after Brexit we recommend including them anyway, in order to avoid delays. CN22 or CN23 forms contain important information regarding the package content and the agreements made on payment of customs costs.

Click here for Government advice and details on Incoterms. Their format is standard and easily recognized by customs authorities all over the world, meaning the process is likely smoother compared to non-standardized customs documents.

Always check the courier’s website as they probably have their own variation of a customs declaration form.

- CN22 form is required for shipping to Europe from the UK, for parcels weighing less than 2Kg with a value up to £270

- CN22A - Use this version when sending items with Royal Mail International Tracking and Signature services

- CN22B - Use this version when sending through the International Economy and International Standard service; it includes a unique barcode for your shipment.

- CN23 form is required for items shipped outside of the UK, for parcels weighing between 2-20 Kg with a value over £270. It contains additional details on your package, such as license and certificate numbers, as well as information on whether the goods are subject to restrictions or inspections.

If you post from Northern Ireland, you will need these forms when you post to non-EU destinations.

VAT and clearing customs

Shipping to Europe after Brexit means you will be charged EU VAT depending on the value of the goods you are selling, whether you sell to businesses or consumers and if you sell on online marketplaces.

- For goods with value up to €22: no longer exempt from VAT and now require formal customs clearance.

- For goods with value up to €150: If you sell directly to EU consumers, you can pay VAT in two ways:

- Bill your account

- Charge consumers VAT at sale and declare it to the EU (for example via the IOSS platform)

- For goods with value above €150: the EU VAT reform only impacts goods valued up to €150 and sold to a consumer. If you are selling to a business or selling goods with a value above €150, you can continue to charge and declare VAT as before.

Check ShippyPro’s tips for a smooth Customs Clearance process here.

Shipping to Europe: carrier updates for 2025

FedEx Updates

![]()

To make the process easier for people shipping to Europe after Brexit, FedEx has introduced:

- FedEx Global Trade Manager: a web service available 24/7 that customers can use to streamline shipping processes when shipping to Europe from the UK and facilitates the customs clearance process. It allows users to locate and print import and export documentation for over 220 countries and easily estimate duties and taxes, as well as any additional fees charged on shipments.

- Read more about changes to UK VAT Rules here

- Click here to discover the FedEx Brexit checklist to help you understand the things your e-commerce needs.

UPS Updates

To make the process easier for people shipping to Europe after Brexit, UPS included a specific section regarding Brexit changes on their website containing all the necessary information to avoid unpleasant situations.

Apart from simplified management systems, we suggest you:

DHL Updates

The carrier DHL created the following sections for users:

- Click here for the online Shipping Outside GB guide that contains useful information such as data requirements, IOSS, Commodity Codes, and charges.

- Discover the checklist to help you ship correctly and avoid customs delays here.

- Paperless Trade service included in their Electronic Shipping Tools for electronic transmission of customs documents.

Bartolini Updates

Click here to read more about Bartolini’s Online Checklist that includes the main requirements when shipping to Europe from the UK and vice versa, namely a list of goods that are not allowed to be exported to the United Kingdom, VAT info and all the necessary shipping documents.

FAQs: shipping to Europe from the UK after Brexit

Do I need an EORI number?

Yes, if you are a business owner. An EORI number is an Economic Operator Registration and Identification number required for UK imports and exports from 2021. If you don’t have one yet click here to apply for your EORI number on the HM Revenue & Customs website or on your local customs authority’s website.

If you are already selling internationally, you may already have an EORI number.

What are CN22 and CN23 and when must I use them?

Businesses and individuals shipping to Europe from the UK will need to fill out a customs declaration form, either CN22 or CN23. These documents are needed when you are sending goods to EU countries. They are used by the Universal Postal Union and are mandatory for postal services like Royal Mail. Private couriers don’t need them, but we advise you to include them anyway as they are the most common customs declarations.

However, always check the specific regulations for the courier you are using, as they may have their own version of a customs declaration form.

- CN22 -for packages weighing up to 2 kilograms with a value of no more than £270.

- CN23 - for packages weighing from 2-20 kilograms with a value greater than £270.

- CN22A - Use this version when sending posts via the International Tracking and Signature services.

- CN22B - Use this version if you’re sending through the International Economy and International Standard service.

What about excise duties, reliefs, drawbacks, and allowances?

You can click here to discover all information on how to treat such goods when shipping to Europe after Brexit on the official government webpage.

Must I include Proof of origin to claim preferential tariff treatment?

Include a Proof of Origin statement if your business wants to claim preferential treatment on the goods imported from the EU or exported to the EU.You can find a detailed guide on when and why to include Proof of Origin documentation on the Government's official webpage 1) Click here and 2) here.

VAT: what changes?

After the 1st of July 2021, all products sent to any country in the EU are subject to VAT, depending on their value and to whom they are sold,and will therefore need customs clearance. Each EU country has specific rules on trade that the UK must follow after Brexit. Please refer to our Vat and customs clearing paragraph above for more details.

How long does it take to ship from the UK to Europe?

Items usually take within 3-5 working days to reach Europe. However there may be delays if Customs Clearance forms and invoices are not filled in properly. Please refer to our Prerequisites to ship to Europe in 2025 in this article to make sure you have all the necessary documentation.

How much does it cost to ship from the UK to Europe?

Prices start from £1.85 but they can vary according to VAT and size/content of the parcel. Please refer to our Vat and customs clearing paragraph above for further details on prices.

Where can I find an HS Code?

The HS Code also known as Commodity Code / Tariff Code is an 8-digit number used to classify products. Discover more about the HM Revenue & Customs classification tool.

Can I start an online business in the UK?

If you are thinking of starting to sell online in the UK you may want to check out ShippyPro’s guide to start an online business in the UK.

Feeling overwhelmed? Simplify the process with ShippyPro

As you may have noticed, shipping internationally and shipping to Europe from the UK is incredibly time-consuming and confusing, especially if so many documents are needed even for one parcel only.

As your business expands, however, dealing with documentation like this is a daily practice that you cannot exempt from but is likely to become overwhelming and even risky if treating a high volume of orders every day. On the other hand, you cannot risk missing out on potential customers, not to mention making them unhappy with delays or additional charges caused by avoidable but highly frequent mistakes.

ShippyPro is supporting all merchants in the process of shipping to Europe after Brexit. Our shipping software is Brexit-compliant, and we are trying to help businesses find the right answers to their questions.

You can book a call and talk to our shipping Experts to find out how your business can grow and benefit from our technology.

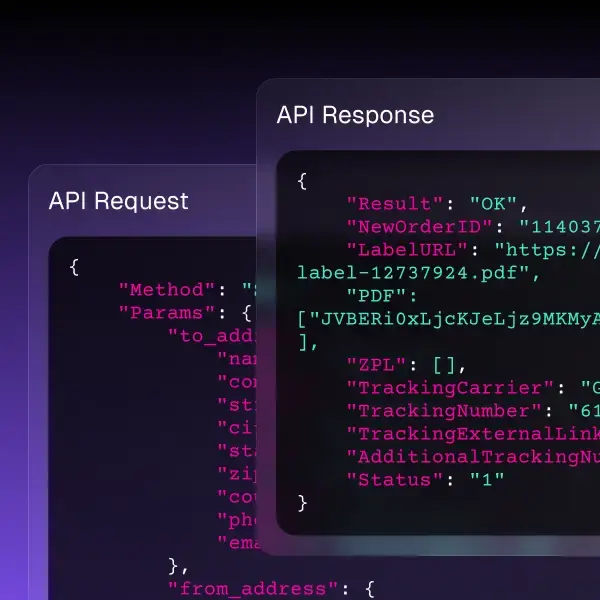

Our all-in-one shipping platform is designed so you can easily ship, track, and return your ecommerce orders for national and international shipments. We handle documents and procedures for you, no matter where your order must go.

The pleasure of not having to worry about handling customs forms again, and having the correct auto-generated, auto-filled documents for all situations is undoubtable, but will also save you time, money and keep all your customers happy, wherever they are.

You can integrate any Markets and Carriers in a few clicks, thanks to the largest integration library available, while our advanced tools allow you to immediately identify errors or incorrect sections regarding your product information. No more issues, just a smooth workflow.

Would you like to offer a class shipping experience? Register to one of our plans now.

Related articles

- Windsor Framework: streamline shipments from Great Britain to Northern Ireland

- UK customs declarations for international shipments

- Customs documentation management: how to simplify the process

Passionate freelance copywriter, with a niche in ecommerce and logistics. When collaborating with ShippyPro, she loves writing about trends, marketing and communication strategies to help brands gain an edge in an ever-evolving digital landscape.